132 Chapter 5 Consumer Choices Answer Key

Chapter 5: Consumer Choices Answer Key

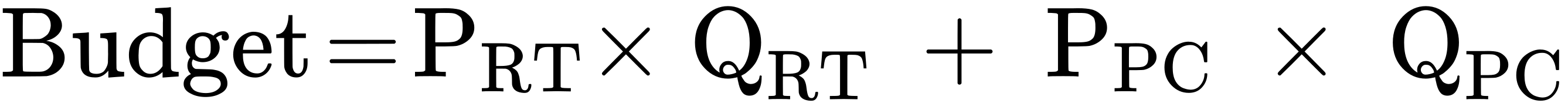

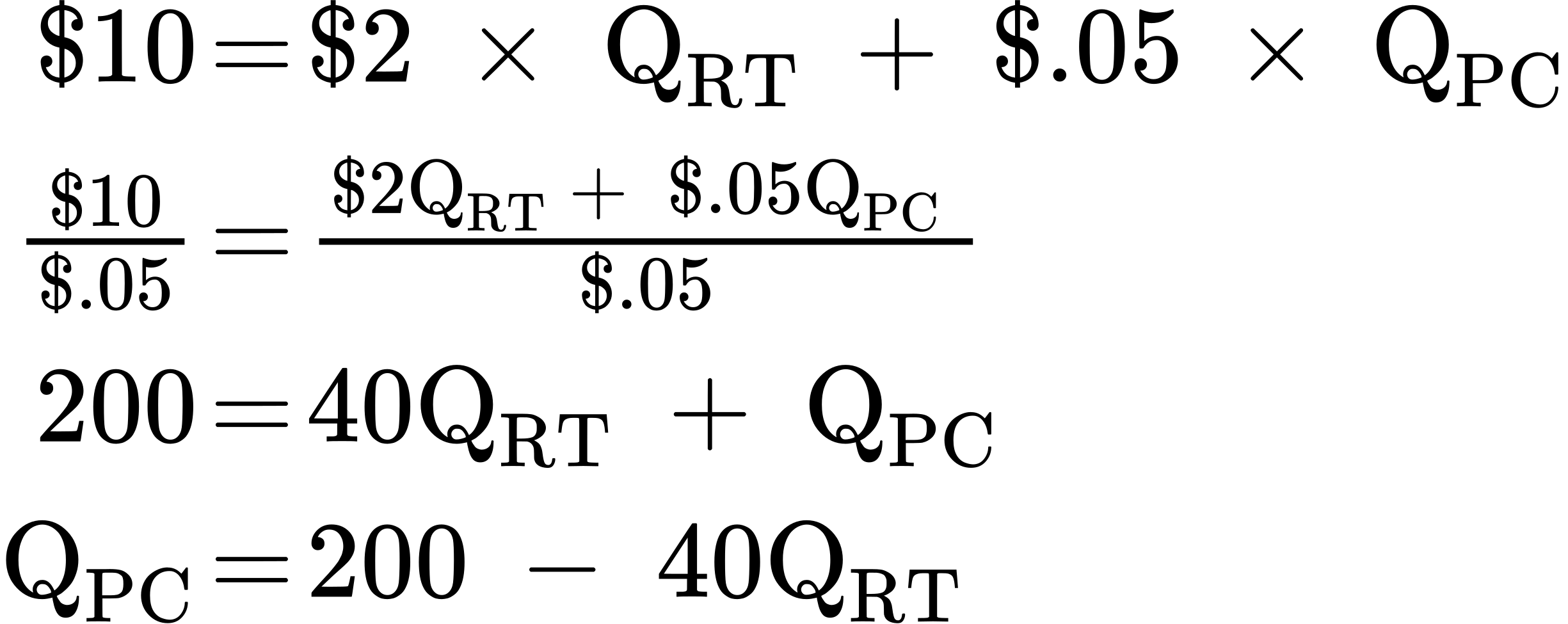

1. The rows of the table in the problem do not represent the actual choices available on the budget set; that is, the combinations of round trips and phone minutes that Jeremy can afford with his budget. One of the choices listed in the problem, the six round trips, is not even available on the budget set. If Jeremy has only $10 to spend and a round trip costs $2 and phone calls cost $0.05 per minute, he could spend his entire budget on five round trips but no phone calls or 200 minutes of phone calls, but no round trips or any combination of the two in between. It is easy to see all of his budget options with a little algebra. The equation for a budget line is:

where P and Q are price and quantity of round trips (RT) and phone calls (PC) (per minute). In Jeremy’s case the equation for the budget line is:

If we choose zero through five round trips (column 1), the table below shows how many phone minutes can be afforded with the budget (column 3). The total utility figures are given in the table below.

|

Round Trips |

Total Utility for Trips |

Phone Minutes |

Total Utility for Minutes |

Total Utility |

|

0 |

0 |

200 |

1100 |

1100 |

|

1 |

80 |

160 |

1040 |

1120 |

|

2 |

150 |

120 |

900 |

1050 |

|

3 |

210 |

80 |

680 |

890 |

|

4 |

260 |

40 |

380 |

640 |

|

5 |

300 |

0 |

0 |

300 |

Adding up total utility for round trips and phone minutes at different points on the budget line gives total utility at each point on the budget line. The highest possible utility is at the combination of one trip and 160 minutes of phone time, with a total utility of 1120.

2. The first step is to use the total utility figures, shown in the table below, to calculate marginal utility, remembering that marginal utility is equal to the change in total utility divided by the change in trips or minutes.

|

Round Trips |

Total Utility |

Marginal Utility (per trip) |

Phone Minutes |

Total Utility |

Marginal Utility (per minute) |

|

0 |

0 |

– |

200 |

1100 |

– |

|

1 |

80 |

80 |

160 |

1040 |

60/40 = 1.5 |

|

2 |

150 |

70 |

120 |

900 |

140/40 = 3.5 |

|

3 |

210 |

60 |

80 |

680 |

220/40 = 5.5 |

|

4 |

260 |

50 |

40 |

380 |

300/40 = 7.5 |

|

5 |

300 |

40 |

0 |

0 |

380/40 = 9.5 |

Note that we cannot directly compare marginal utilities, since the units are trips versus phone minutes. We need a common denominator for comparison, which is price. Dividing MU by the price, yields columns 4 and 8 in the table below.

|

Round Trips |

Total Utility |

Marginal Utility (per trip) |

MU/P |

Phone Minutes |

Total Utility |

Marginal utility (per minute) |

MU/P |

|

0 |

0 |

– |

– |

200 |

1100 |

60/40 = 1.5 |

1.5/$0.05 = 30 |

|

1 |

80 |

80 |

80/$2 = 40 |

160 |

1040 |

140/40 = 3.5 |

3.5/$0.05 = 70 |

|

2 |

150 |

70 |

70/$2 = 35 |

120 |

900 |

220/40 = 5.5 |

5.5/$0.05 = 110 |

|

3 |

210 |

60 |

60/$2 = 30 |

80 |

680 |

300/40 =7.5 |

7.5/$0.05 = 150 |

|

4 |

260 |

50 |

50/$2 = 25 |

40 |

380 |

380/40 = 9.5 |

9.5/$0.05 = 190 |

|

5 |

300 |

40 |

40/$2 = 20 |

0 |

0 |

– |

– |

Start at the bottom of the table where the combination of round trips and phone minutes is (5, 0). This starting point is arbitrary, but the numbers in this example work best starting from the bottom. Suppose we consider moving to the next point up. At (4, 40), the marginal utility per dollar spent on a round trip is 25. The marginal utility per dollar spent on phone minutes is 190.

Since 25 < 190, we are getting much more utility per dollar spent on phone minutes, so let’s choose more of those. At (3, 80), MU/PRT is 30 < 150 (the MU/PM), but notice that the difference is narrowing. We keep trading round trips for phone minutes until we get to (1, 160), which is the best we can do. The MU/P comparison is as close as it is going to get (40 vs. 70). Often in the real world, it is not possible to get MU/P exactly equal for both products, so you get as close as you can.

3. This is the opposite of the example explained in the text. A decrease in price has a substitution effect and an income effect. The substitution effect says that because the product is cheaper relative to other things the consumer purchases, the consumer will tend to buy more of the product (and less of the other things). The income effect says that after the price decline, the consumer could purchase the same goods as before, and still have money left over to purchase more. For both reasons, a decrease in price causes an increase in quantity demanded.

4. This is a negative income effect. Because your parents’ check failed to arrive, your monthly income is less than normal and your budget constraint shifts in toward the origin. If you only buy normal goods, the decrease in your income means you will buy less of every product.

Access for free at https://openstax.org/books/principles-economics-3e