45 The Confusion Over Inflation

Laura Prince and OpenStax

The Confusion Over Inflation

Learning Objectives

By the end of this session, you will be able to:

- Explain how inflation can cause redistributions of purchasing power

- Identify ways inflation can blur the perception of supply and demand

- Explain the economic benefits and challenges of inflations

Economists usually oppose high inflation, but they oppose it in a milder way than many non-economists. Robert Shiller, one of 2013’s Nobel Prize winners in economics, carried out several surveys during the 1990s about attitudes toward inflation. One of his questions asked, “Do you agree that preventing high inflation is an important national priority, as important as preventing drug use or preventing deterioration in the quality of our schools?” Answers were on a scale of 1–5, where 1 meant “Fully agree” and 5 meant “Completely disagree.” For the U.S. population as a whole, 52% answered “Fully agree” that preventing high inflation was a highly important national priority and just 4% said “Completely disagree.” However, among professional economists, only 18% answered “Fully agree,” while the same percentage of 18% answered “Completely disagree.”

The Land of Funny Money

What are the economic problems caused by inflation, and why do economists often regard them with less concern than the general public? Consider a very short story: “The Land of Funny Money.”

One morning, everyone in the Land of Funny Money awakened to find that everything denominated in money had increased by 20%. The change was completely unexpected. Every price in every store was 20% higher. Paychecks were 20% higher. Interest rates were 20 % higher. The amount of money, everywhere from wallets to savings accounts, was 20% larger. This overnight inflation of prices made newspaper headlines everywhere in the Land of Funny Money. However, the headlines quickly disappeared, as people realized that in terms of what they could actually buy with their incomes, this inflation had no economic impact. Everyone’s pay could still buy exactly the same set of goods as it did before. Everyone’s savings were still sufficient to buy exactly the same car, vacation, or retirement that they could have bought before. Equal levels of inflation in all wages and prices ended up not mattering much at all.

When the people in Robert Shiller’s surveys explained their concern about inflation, one typical reason was that they feared that as prices rose, they would not be able to afford to buy as much. In other words, people were worried because they did not live in a place like the Land of Funny Money, where all prices and wages rose simultaneously. Instead, people live here on Planet Earth, where prices might rise while wages do not rise at all, or where wages rise more slowly than prices.

Economists note that over most periods, the inflation level in prices is roughly similar to the inflation level in wages, and so they reason that, on average, over time, people’s economic status is not greatly changed by inflation. If all prices, wages, and interest rates adjusted automatically and immediately with inflation, as in the Land of Funny Money, then no one’s purchasing power, profits, or real loan payments would change.

However, if other economic variables do not move exactly in sync with inflation, or if they adjust for inflation only after a time lag, then inflation can cause three types of problems: unintended redistributions of purchasing power, blurred price signals, and difficulties in long-term planning.

Who is Hurt by Inflation

Inflation can cause redistributions of purchasing power that hurt some and help others. People who are hurt by inflation include those who are holding considerable cash, whether it is in a safe deposit box or in a cardboard box under the bed. When inflation happens, the buying power of cash diminishes. However, cash is only an example of a more general problem: anyone who has financial assets invested in a way that the nominal return does not keep up with inflation will tend to be affected by inflation. For example, if a person has money in a bank account that pays 4% interest, but inflation rises to 5%, then the real rate of return for the money invested in that bank account is negative 1%.

The problem of a good-looking nominal interest rate transforming into an ugly-looking real interest rate can be worsened by taxes. The U.S. income tax is charged on the nominal interest received in dollar terms, without an adjustment for inflation. Thus, the government taxes a person who invests $10,000 and receives a 5% nominal rate of interest on the $500 received—no matter whether the inflation rate is 0%, 5%, or 10%. If inflation is 0%, then the real interest rate is 5% and all $500 is a gain in buying power. However, if inflation is 5%, then the real interest rate is zero and the person had no real gain—but owes income tax on the nominal gain anyway. If inflation is 10%, then the real interest rate is negative 5% and the person is actually falling behind in buying power, but would still owe taxes on the $500 in nominal gains.

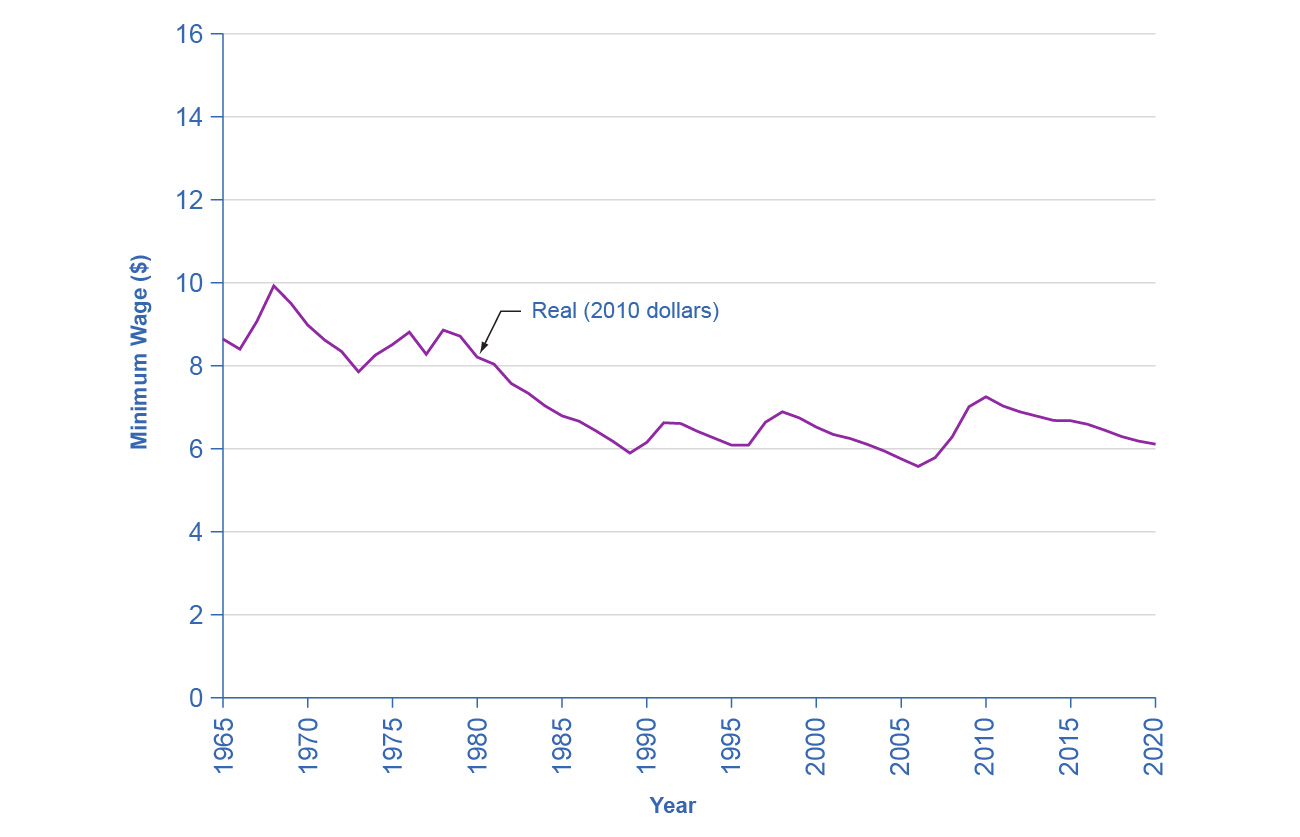

Inflation can cause unintended redistributions for wage earners, too. Wages do typically creep up with inflation over time, eventually. Increases in wages may lag behind inflation for a year or two, since wage adjustments are often somewhat sticky and occur only once or twice a year. Moreover, the extent to which wages keep up with inflation creates insecurity for workers and may involve painful, prolonged conflicts between employers and employees. If the government adjusts minimum wage for inflation only infrequently, minimum wage workers are losing purchasing power from their nominal wages, as Figure 22.6 shows.

Figure 22.6 U.S. Minimum Wage and Inflation After adjusting for inflation, the federal minimum wage dropped about 30 percent from 1965–2020, even though the nominal figure climbed from $1.40 to $7.25 per hour. Increases in the minimum wage in between 2008 and 2010 kept the decline from being worse—as it would have been if the wage had remained the same as it did from 1997 through 2007. Since 2010, the real minimum wage has continued to decline. (Sources: http://www.dol.gov/whd/minwage/chart.htm and http://data.bls.gov/cgi-bin/surveymost?cu)

One sizable group of people has often received a large share of their income in a form that does not increase over time: retirees who receive a private company pension. Most pensions have traditionally been set as a fixed nominal dollar amount per year at retirement. For this reason, economists call pensions “defined benefits” plans. Even if inflation is low, the combination of inflation and a fixed income can create a substantial problem over time. A person who retires on a fixed income at age 65 will find that losing just 1% to 2% of buying power per year to inflation compounds to a considerable loss of buying power after a decade or two.

Who Benefits from Inflation

People can sometimes benefit from the unintended redistributions of inflation. Consider someone who borrows $10,000 to buy a car at a fixed interest rate of 9%. If inflation is 3% at the time the loan is made, then the borrower must repay the loan at a real interest rate of 6%. However, if inflation rises to 9%, then the real interest rate on the loan is zero. In this case, the borrower’s benefit from inflation is the lender’s loss. A borrower paying a fixed interest rate, who benefits from inflation, is just the flip side of an investor receiving a fixed interest rate, who suffers from inflation. The lesson is that when interest rates are fixed, rises in the rate of inflation tend to penalize suppliers of financial capital, who receive repayment in dollars that are worth less because of inflation, while demanders of financial capital end up better off, because they can repay their loans in dollars that are worth less than originally expected.

The unintended redistributions of buying power that inflation causes may have a broader effect on society. America’s widespread acceptance of market forces rests on a perception that people’s actions have a reasonable connection to market outcomes. When inflation causes a retiree who built up a pension or invested at a fixed interest rate to suffer, however, while someone who borrowed at a fixed interest rate benefits from inflation, it is hard to believe that this outcome was deserved in any way. Similarly, when homeowners benefit from inflation because the price of their homes rises, while renters suffer because they are paying higher rent, it is hard to see any useful incentive effects. One of the reasons that the general public dislikes inflation is a sense that it makes economic rewards and penalties more arbitrary—and therefore likely to be perceived as unfair.

Blurred Price Signals

Prices are the messengers in a market economy, conveying information about conditions of demand and supply. Inflation blurs those price messages. Inflation means that we perceive price signals more vaguely, like a radio program received with considerable static. If the static becomes severe, it is hard to tell what is happening.

High and variable inflation means that the incentives in the economy to adjust in response to changes in prices are weaker. Markets will adjust toward their equilibrium prices and quantities more erratically and slowly, and many individual markets will experience a greater chance of surpluses and shortages.

Problems of Long-Term Planning

Inflation can make long-term planning difficult. In discussing unintended redistributions, we considered the case of someone trying to plan for retirement with a pension that is fixed in nominal terms and a high rate of inflation. Similar problems arise for all people trying to save for retirement, because they must consider what their money will really buy several decades in the future when we cannot know the rate of future inflation.

Access for free at https://openstax.org/books/principles-economics-3e