17 Tracking Real GDP over Time and the Business Cycle

Laura Prince and OpenStax

Tracking Real GDP over Time and the Business Cycle

Learning Objectives

By the end of this section, you will be able to:

- Analyze and discuss the business cycle

- Explain recessions, depressions, peaks, and troughs

- Evaluate the importance of tracking real GDP over time

When news reports indicate that “the economy grew 1.2% in the first quarter,” the reports are referring to the percentage change in real GDP. By convention, governments report GDP growth at an annualized rate: Whatever the calculated growth in real GDP was for the quarter, we multiply it by four when it is reported as if the economy were growing at that rate for a full year.

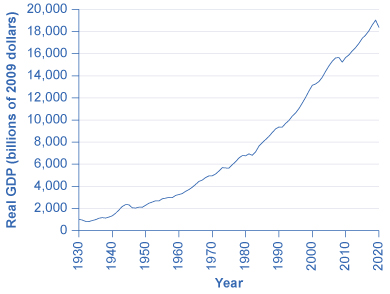

Figure 19.10 U.S. GDP, 1930–2020 Real GDP in the United States in 2020 (in 2012 dollars) was about $18.4 trillion. After adjusting to remove the effects of inflation, this represents a roughly 20-fold increase in the economy’s production of goods and services since 1930. (Source: bea.gov)

Figure 19.10 shows the pattern of U.S. real GDP since 1930. Short term declines have regularly interrupted the generally upward long-term path of GDP. We call a significant decline in real GDP a recession. We call an especially lengthy and deep recession a depression. The severe drop in GDP that occurred during the 1930s Great Depression is clearly visible in the figure, as is the 2008–2009 Great Recession and the recession induced by COVID-19 in 2020.

Real GDP is important because it is highly correlated with other measures of economic activity, like employment and unemployment. When real GDP rises, so does employment.

Business Cycle

Economists use the term business cycle to describe the ups and downs, or fluctuations, in an economy. More specifically, the term refers to the fluctuating levels of economic activity over a period of time measured from the beginning of one recession to the beginning of the next. The upward and downward movements indicate specific phases of the business cycle.

The upward slope of the business cycle is called economic expansion. An expansion is a period when economic output increases. That is, more goods and services are being produced in the economy.

As the economy expands, businesses, or “firms,” tend to use more resources—including labor. In other words, as firms increase output, they usually hire more workers. As a result, when output rises, employment tends to rise as well.

So, economic expansion usually means that two key economic indicators are increasing—economic output and employment. In practical terms, this means that the economy is producing more of the goods and services that we want and more people have jobs. More jobs mean more people with incomes to purchase goods and services. These are favorable outcomes. And you can likely see how more employment and income can help push the economy to even higher levels of output.

It would sure be nice if the economy would expand continuously, but all expansions come to an end. In economic terms, they reach a peak, which, like on a roller coaster ride, is the point just before the downward movement begins.

The downward slope of the business cycle is called economic contraction. A contraction is a period when economic output declines. During this phase, the economy is producing fewer goods and services than it did before. When fewer goods and services are produced, fewer resources are used by firms—including labor. As firms decrease their output, they will hire few or even no new workers and often lay off some existing workers. As a result, when output falls, employment tends to fall as well.

Economic contractions often become recessions. A recession is a significant decline in general economic activity extending over a period of time. A general rule of thumb is that two consecutive quarters of economic contraction constitute a recession.

Recessions result in economic hardship for many people and can have long-lasting effects. For example, losing a job due to recession can lead to high levels of debt or the loss of key assets such as a house or a car. In addition, if people are unemployed for long periods of time, they might find it difficult to keep their work skills sharp, and they might find it difficult to find another job.

Recessions are unpleasant, but fortunately they don’t last forever. In economic terms, they reach a trough, which is the point just before the upward movement begins.

The initial increase in output contributes to economic recovery, which is movement back to the level of output that existed before the recession began. If output continues to increase beyond this previous high mark, then the next expansion begins.

Problems For Human Beings When Business Cycle Goes Through Cycle

The most significant human problem associated with recessions (and their larger, uglier cousins, depressions) is that a slowdown in production means that firms need to lay off or fire some of their workers. Losing a job imposes painful financial and personal costs on workers, and often on their extended families as well. In addition, even those who keep their jobs are likely to find that wage raises are scanty at best—or their employers may ask them to take pay cuts. On the other end of expansion cycle. If it moves too quickly – we may get high inflation. Which is painful because – we pay higher overall prices. And if we and businesses cannot plan for those increases – we will have to make possible painful adjustments to account for the higher prices.

Who Tracks the Business Cycle

A private think tank – The National Bureau of Economic Research—the NBER—is a group of economists who, in addition to doing economic research, examine data and identify the specific starting dates for the phases of the business cycle. To make their decision, they examine a variety of economic data. Of course, time is needed to collect and analyze data, so there is a time lag between when a business cycle phase begins and when the NBER announces that it has begun. In the past, the time between an actual change and the NBER announcement has been anywhere from 6 months to 21 months. The NBER Business Cycle Dating Committee prefers to wait long enough and see enough data to minimize any doubts about the turning point.

The term “cycle” in business cycle can be misleading because it implies regularity. For example, the rinse cycle on my dishwasher is predictable: It always begins 45 minutes after the wash cycle begins, and it always lasts 9 minutes.

There is nothing regular about the business cycle, though. Recessions and expansions are unpredictable and their lengths vary.

How Do We Smooth Out Recessions and Expansions?

Helping to make those two things happen is part of the role of the Federal Reserve. The Federal Reserve has been mandated by Congress to promote maximum employment and price stability—it’s called the Fed’s dual mandate. During a recession, output is below capacity, and there are many unemployed workers. To help the economy grow, the Federal Reserve uses its monetary policy tools to decrease interest rates. Lower interest rates encourage consumers to borrow money—for example, to buy cars or homes, and businesses to invest and expand. This borrowing and spending will cause firms to increase their output to meet the growing demand. As output increases, firms will likely use more resources and hire additional workers. Eventually, more resources, more workers, and more output will move the economy from recession to expansion again. In this way, the Federal Reserve uses its monetary policy tools to promote “maximum employment”—one component of the dual mandate—and smooth the business cycle.

To fulfill its “price stability” mandate—so, to keep prices low and stable—the Federal Reserve tries to keep inflation in check. The Fed wants to keep inflation around 2 percent. When inflation remains low and stable over time, businesses and individuals can plan their future investment and spending because prices remain fairly predictable. Such price stability promotes economic expansion, which, as we’ve discussed, also promotes employment. In effect, as the Federal Reserve pursues its dual mandate of maximum employment and price stability, it helps smooth some of the rough spots in the business cycle.

By design, a roller coaster has many ups and downs. However, when it comes to the economy, most people prefer a smooth ride with very few dips. It would be much easier to plan for the future if recessions were easy to predict, but they are not. Rather they are unpredictable and irregular. The Federal Reserve has a role to play in smoothing the rough spots out of the business cycle. The Fed uses its monetary policy tools to promote maximum employment and price stability in the economy. In other words, the Federal Reserve attempts to take some of the dips out of the economic ride to produce a smoother business cycle. Source Federal Reserve Bank of St. Louis. For more information, visit stlouisfed.org.

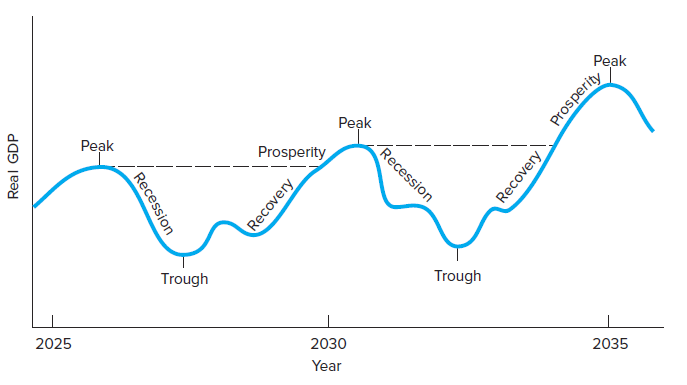

Figure 10.3 Hypothetical Business Cycles

The three-phase business cycle runs from peak to peak, beginning with a recession(contraction), which ends at a trough, followed by a recovery(expansion). When the level of the previous peak is attained, prosperity sets in, continuing until a new peak is reached

Are Economic Fluctuations Becoming Less Extreme?

Recessions and expansions are both becoming milder. There is nothing regular about the business cycle, though. Recessions and expansions are unpredictable and their lengths vary.

Why Are They: Jobs of Fiscal and Monetary Policy

Helping to make those two things happen is part of the role of the Federal Reserve. The Federal Reserve has been mandated by Congress to promote maximum employment and price stability—it’s called the Fed’s dual mandate. During a recession, output is below capacity, and there are many unemployed workers. To help the economy grow, the Federal Reserve uses its monetary policy tools to decrease interest rates. Lower interest rates encourage consumers to borrow money—for example, to buy cars or homes, and businesses to invest and expand. This borrowing and spending will cause firms to increase their output to meet the growing demand. As output increases, firms will likely use more resources and hire additional workers. Eventually, more resources, more workers, and more output will move the economy from recession to expansion again. In this way, the Federal Reserve uses its monetary policy tools to promote “maximum employment”—one component of the dual mandate—and smooth the business cycle.

To fulfill its “price stability” mandate—so, to keep prices low and stable—the Federal Reserve tries to keep inflation in check. The Fed wants to keep inflation around 2 percent. When inflation remains low and stable over time, businesses and individuals can plan their future investment and spending because prices remain fairly predictable. Such price stability promotes economic expansion, which, as we’ve discussed, also promotes employment. In effect, as the Federal Reserve pursues its dual mandate of maximum employment and price stability, it helps smooth some of the rough spots in the business cycle.

By design, a roller coaster has many ups and downs. However, when it comes to the economy, most people prefer a smooth ride with very few dips. It would be much easier to plan for the future if recessions were easy to predict, but they are not. Rather they are unpredictable and irregular. The Federal Reserve has a role to play in smoothing the rough spots out of the business cycle. The Fed uses its monetary policy tools to promote maximum employment and price stability in the economy. In other words, the Federal Reserve attempts to take some of the dips out of the economic ride to produce a smoother business cycle. Source: Federal Reserve Bank of St. Louis visit stlouisfed.org.

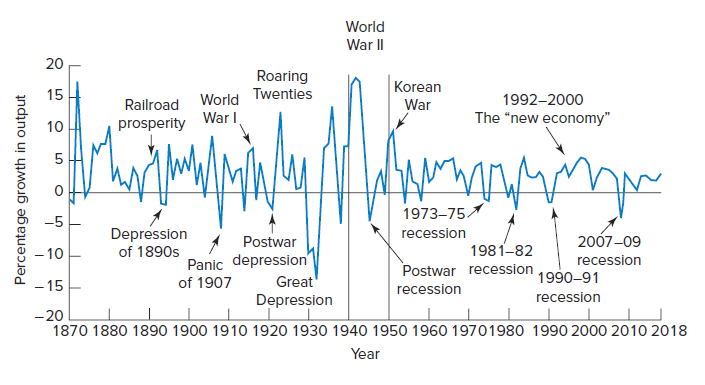

Figure 10.4 Fluctuations in Real GDP,

1860–2018

Sources: Historical Statistics of the United States, Colonial Times to 1970; U.S. Department of Commerce, www .commerce.gov.

Notice that the cycles after 1950 do not go as high or fall as low. This represents the modulation of the cycles. It means they are not as extreme – which translates to less disruptions to our personal and business lives.

Access for free at https://openstax.org/books/principles-economics-3e