1 Foundations of Economics

Learning Objectives

- Economic Way of Thinking and Framework

- Cost and Benefits

- Scarcity: The Basic Economic Problem

- Economic Systems

- Opportunity Cost

- Productivity

- The Price System

- The Circular Flow of Market Economy

- Role of Government – Externalities

Economic Definition

Economics is the study of how society chooses to allocate its scarce productive resources in order to satisfy unlimited human wants and needs.

Economic Goals

The goal of economics to obtain the greatest value from resources. The field of economics is very broad. Ranging from personal to global issues.

Branches of Economics

Microeconomics: focuses on the choices made by households and firms and the effects those choices have on certain markets.

Examples:

Making personal or managerial decisions

Understanding how markets work

Analyzing government policies

Macroeconomics: focuses on the overall performance of the economy and the behavior of the economy. The total output, employment, and the price level are all considered.

Examples:

What causes unemployment?

Who controls the money supply?

What are fiscal policy and monetary policy?

What are business cycles?

The Economic Way of Thinking, Framework, and Basic Concepts

Economists use a framework to approach complex problems and make decisions.

The economic way of thinking using a framework to examine how people make choices under conditions of scarcity and systems of production, consumption, and distribution. The practice of economics often calls for analysis of a complex problem. Although economists may differ in their views, they have developed an economic way of thinking it is based on several principles or a framework.

The economic way of thinking framework consists of:

- Every Choice has a Cost

- People Make Better Choices by Thinking at the Margin

- Rational Self-Interest

- Economics Models

- Positive versus Normative

Every Choice Has a Cost

Because human and property resources are scarce, individuals and societies must choose how to best use them. Making choices requires trading one thing for another. At the core of economics is the idea that there is no such thing as a “free lunch”. For example, a friend paid for your lunch, making it “free” to you. But it is not free, there is still a cost to your friend and ultimately to society. This idea expressed as the fundamental principle of economics: every choice involves a cost. Another example, school lunches in Wisconsin are free to students. But they are not free to society. There is a cost. Taxes from taxpayers pay the cost of lunches. What did we give up in order to use the tool of taxes to get the “free lunches” for schools? Are we giving up tax money being directed to fight climate change or help people being evicted because of job loss? More specifically, the cost is termed the opportunity cost. What opportunity are we giving up in order to have free lunches? This always involves a tradeoff in choices. On the flip side, what are the benefits of the “free lunch” for students? Do we benefit as individuals and as a society when students are fed? Does it make learning more productive and therefore a benefit to the state of Wisconsin?

The cost of any choice is the value of the best opportunity that is foregone by making the choice. This is the opportunity cost. For example, you can choose to remain in college or quit college. If you quit, you may find a job at Burger King and earn enough money to buy some clothes, rent some videos, maybe go skiing and hang out with your friends. If you remain in college, you will not be able to afford all of these things, now. However, your education will enable you to find a better job later and then you will be able to afford these things – plus many other items. In addition, you will add the abilities that you learn college to the overall society.

People Make Better Choices by Thinking at the Margin

Economists maintain that people make better choices by thinking at the margin. Making a choice at the margin means deciding to do a little more or a little less of an activity. As a student, you can allocate the next hour to sleeping or studying. In making this decision, you compare the benefit of extra study time to the cost of foregone sleep.

Most choices involve marginal analysis, which means examining the benefits and costs of choosing a little more or a little less of a good. People naturally compare costs and benefits, but often we look at total costs and total benefits, when the optimal choice necessitates comparing how costs and benefits change from one option to another. You might think of marginal analysis as “change analysis.” Marginal analysis is used throughout economics.

The law of diminishing marginal utility (satisfaction from the good or service), means that as a person receives more of a good, the additional (or marginal) utility (satisfaction from the good or service) from each additional unit of the good declines. In other words, the first slice of pizza brings more satisfaction than the sixth.

The law of diminishing marginal utility explains why people and societies rarely make all-or-nothing choices. You would not say, “My favorite food is ice cream, so I will eat nothing but ice cream from now on.” Instead, even if you get a very high level of utility (satisfaction) from your favorite food, if you ate it exclusively, the additional or marginal utility from those last few servings would not be very high. Similarly, most workers do not say: “I enjoy leisure, so I’ll never work.” Instead, workers recognize that even though some leisure is very nice, a combination of all leisure and no income is not so attractive. The budget constraint framework suggests that when people make choices in a world of scarcity, they will use marginal analysis and think about whether they would prefer a little more or a little less.

Rational Self-Interest

Economics is founded on the assumption of rational self-interested humans. This means that people act as if they are motivated by self-interest and respond predictably to opportunities for gain. In other words, people try to make the best of any situation. Often making the best of a situation involves maximizing the value of some quantity. As a student, getting high grades may be an incentive to study hard (cost) because they may help you obtain a job interview with an employer (benefit) or get accepted to a college (benefit). Which will in turn earn you more “pleasure” “benefit” or “money” (benefit). We assume that economic incentives underlie the rational decisions that people make. Because income is limited and the goods have prices, we cannot buy all the things we would like to have. Therefore, we should choose an attainable combination of goods and/or services that will maximize our satisfaction. Of course, self-interest does not always imply increasing one’s wealth, as measured in dollars, or one satisfaction from the amount of goods and/or services consumed. In addition to economic motivations, people also have goals pertaining to friendship, love, altruism, creativity, and the like.

Economic Models

Like other sciences, economics uses models. In chemistry, you may have seen a model of an atom, a device with blue, green blue, and red balls that represent neutrons electrons and protons. Economic models are not built with plastic or cardboard but rather with words, diagrams, and mathematical equations.

Economic models, or theories, or simplified representations of the real world that we use to help us understand, explain, and predict economic phenomena in the real world. Economic models might explain inflation, unemployment, wage rates, and more. For example, an economic model might tell us how the quantity of movies that consumers purchase will change if the seller raises the price. We will use economic models to help us understand contemporary economic issues.

Positive vs. Normative Economics

It is important to realize that economics is not always free of value judgments. And thinking about economic questions, we must distinguish questions of fact from questions of values or fairness.

Positive economics describes the facts of the economy. Positive economics deals with the way in which the economy Works. Positive economics consider such questions as, why do computer scientist earn more than janitors? What is the economic effect of reducing taxes? Does free trade result in job loss for low-skilled workers? Although the questions are really difficult to answer, they can be addressed by economic analysis and empirical evidence.

Normative economics involves value judgments that cannot be tested empirically. Ethical standards and norms of fairness underlie normative economics. For example, should the United States penalize China for violating US patent and copyright laws? Should welfare payments be reduced in order to encourage the unemployed to find income-producing jobs? Should all Americans have equal access to healthcare? Because these questions involve value judgments instead of facts, there are no right or wrong answers.

Both positive and normative economics are important and will be considered in this course.

Cost/Benefit: The Study of Trade Offs and Choices

Cost-benefit analysis in economics is the exercise of evaluating a planned action by determining and quantifying factors involved.

- Adds all the positive factors. These are the benefits.

- Then it identifies, quantifies, and subtracts all the negatives, the costs; including opportunity cost.

- The difference between the two indicates whether the planned action is advisable.

The real key to doing a successful cost-benefit analysis is making sure to include all the costs and all the benefits and properly quantify them. It is the fundamental assessment behind virtually every economic and business decision, due to the simple fact that business managers do not want to spend money unless the benefits that derive from the expenditure are expected to exceed the costs.

The big difference between business cost/benefit analysis and economic cost/benefit analysis is that economics includes all opportunity costs while businesses do not. For example, what does it cost society if a business pollutes the environment or cuts down all trees in order to make a profit. A business does not typically look at those costs. They are simply concerned with the business costs and benefits and how to make a profit – not what is good or bad for society.

Cost-benefit analysis is a decision support method used to help answer questions that often start with “what if” or “should we” (Inc.com, 2012).

What About the Hidden Costs?

The concept of opportunity cost is important to all decision-making processes. The opportunity cost of a course of action is the forgone benefit from an alternative action. The only way this can happen it that a person cannot do both actions at the same time.

Our lives are made up of choices about mutually exclusive actions, from deciding to go to college instead of working full-time for four years, to choosing between coffee or tea during a quick break.

Opportunity cost can be computed in terms of anything — including money, ice cream cones, love, life experience, friendship, and “achievement.”

The concept of opportunity cost reflects the scarcity of our resources (bottom line in economics) — especially time and money.

When we integrate opportunity cost into our decision-making, we ensure the most efficient use of our scarce resources. Opportunity cost can be computed in terms of anything — including money, ice cream cones, love, life experience, friendship, and “achievement.”

When we integrate opportunity cost into our decision-making, we ensure the most efficient use of our scarce resources.

Suppose, for example, we wished to evaluate the benefits and costs of a proposal to control air pollution emissions from a large factory. On the benefit side, pollution reduction will mean reduced damage to exposed materials, diminished health risks to people living nearby, improved visibility, and even new jobs for those who manufacture pollution control equipment. On the cost side, the required investments in pollution control may cause the firm to raise the price of its products, close down several higher cost operations at its plant and lay off workers, and put off other planned investments designed to modernize its production facilities.

Framework Example: Every Choice Has a Cost and Benefits

Introduction: One way to understand the tradeoffs that need to be made is to think in terms of costs and benefits.

Reflect: After watching the video, consider this case: According the University of Utah study, using a cell phone while driving, whether it’s handheld or hands-free, delays a driver’s reactions as much as having a blood alcohol concentration at the legal limit of .08 percent. That is driving while texting can create a serious danger.

Do some research and consider these questions:

- List the groups or individuals most affected by the situation.

- What do YOU think the government should do or not do?

- What are the COSTS and BENEFITS of your solution?

- Which individuals or groups will be the WINNERS (better off than before) if your government solution is adopted? Which individuals or groups will be LOSERS (worse off than before)?

NOTE: Even though there is a terrible cost to driving while texting, there are WINNERS that do benefit. Such as, the companies that clean up accidents on the highway, cell phone companies, etc.

Scarcity: The Basic Problem

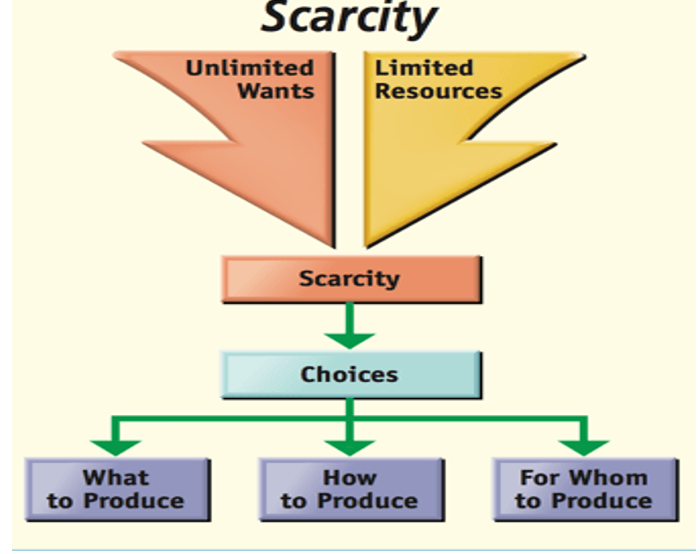

Scarcity is the tension between unlimited human wants/needs and the limited productive resources available for satisfying these and this represents scarcity. Scarcity notes that economic productive resources — land, labor, capital, and entrepreneurial ability — are limited, not infinite.

Scarcity is the tension between unlimited human wants/needs and the limited productive resources available for satisfying these and this represents scarcity. Scarcity notes that economic productive resources — land, labor, capital, and entrepreneurial ability — are limited, not infinite.

Note: Be careful to really think this through – the economic use of the word does not correspond exactly with the common usage of the word.

The study of economics explains how productive resources are used to provide the goods and services that satisfy human wants/needs. Productive resources are limited and the goods and services that can be produced from them are also limited. However, remember – the goods and services wanted by individuals and societies are virtually unlimited. We, as humans tend to want it all.

Productive Resources

Every society is endowed with resources which are used to produce the goods and services that enable society to survive and prosper.

The productive resources are:

- Land – which is shorthand for all natural resources. Examples: minerals, timber, soil, water, and the land itself. (created by nature)

- Labor – describes the human work effort, both physical and mental, expended on the production.

- Capital – includes the human-made physical resources such as buildings tools machines and equipment used in production (created by humans)

- Entrepreneurial ability – combines the other three factors of production to add to supply. They are risk takers seeking a profit.

Remember: Productive Resources limited – Human wants unlimited.

Remember: Scarcity is one of the foundational ideas – and its implications can have a drastic impact on the ways a society produces its goods and services. In economics, the term scarcity refers to the idea that an economic system cannot possibly produce all of the goods/services that consumers want.

The combined effect of unlimited wants and limited resources creates a reduction in the availability of goods and services. Ultimately, this suggests that consumers must make selective and complicated decisions about how finite resources (land, labor, capital and entrepreneurial capital) should be used. As we will see in the case of natural water supplies below, incorrect decisions in these areas can lead to drastically negative consequences in the everyday lives of consumers.

Economic Examples

(Source: https://discusseconomics.com/global-economics/foundations-economics-law-scarcity/)

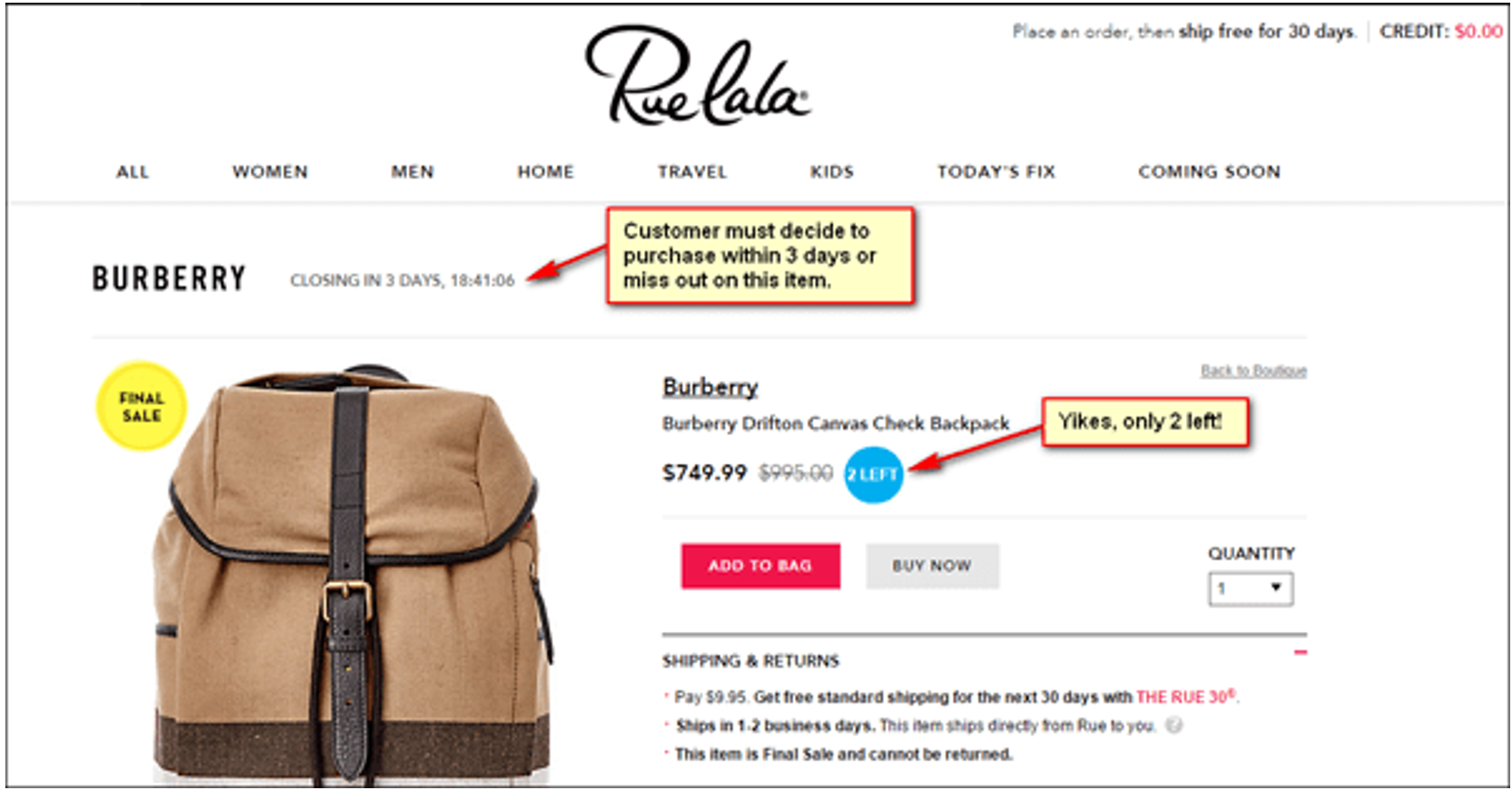

For some, these ideas might sound like unrelatable, abstract economic concepts. But the reality is that there are occurrences that can easily be found on a day-to-day basis. In the graphic below, we can see a scenario that many online shoppers might find when making regular purchasing decisions.

Anyone interested in this Burberry handbag faces a purchasing decision that is closely tied to the Law of Scarcity. Discounted prices can be found here but time and resource availability are limited to three days. In addition to this, there are only two of these handbags available in the market.

This means a consumer must act quickly in order to take advantage of the item’s sale price. Of course, these are all factors that can have a significant impact on the ebb and flow of the daily activity that is seen in the consumer markets. But the effects of these trends can extend into the macro-economy, as well.

Example: Global Economic Theory in Practice

To illustrate this idea using real-world trends, we can look at water as a resource commodity that serves many of the most basic human needs. But what many may not know is that a growing number of people face water scarcity to an alarming degree.

Scarcity Summary

As we can see, SCARCITY can play an important role in the daily lives of consumers. Ideas that may seem to be abstract or overly academic – can actually have a significant influence in the ways that a society produces and sells its goods/services in the market. As long as the world has limited means and unlimited wants, there will always be choices that must be made. The laws of economics can help us make more informed decisions in these areas so that we can meet as many human needs as possible.

How to Handle Scarcity with Economic Systems

The existence of scarcity creates the basic economic problem faced by every society, rich or poor:

Problem: How to make the best use of limited resources to satisfy human wants is the goal. Each society must first decide what to do with the resources they have. They need to answer to the following questions based on an economic system of choice.

To solve this basic problem, every society must answer these questions: Howwe answer these question will be based on the type of economic system we use in our society.

- What goods and services will be produced?

- How will the goods and services be produced?

- How will we divide up or decide to gets what?

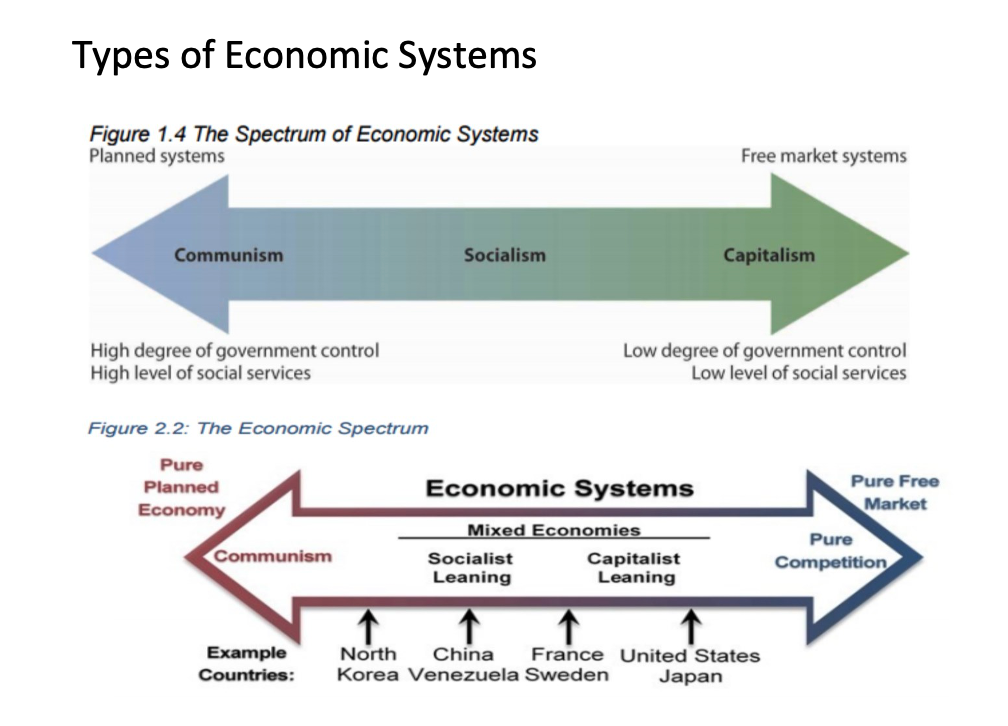

Types of Economic Systems

Take a look at the graphic below and notice the common names for the 4 types of systems:

- Traditional

- Command

- Market

- Mixed

Several fundamental types of economic systems exist to answer the three questions of what, how and for whom to produce: traditional, command, market, and mixed. These systems help societies by asking the main questions all societies must address when dealing with scarcity. Look at the different way each system deals scarcity.

Traditional Economics

In the traditional economy, economic decisions are based on custom and historical precedent. For example, in tribal cultures or in cultures characterized by a caste system, people in particular social strata often perform the same type of work as their parents and grandparents regardless of ability or potential. What, How and Who is answered the way they always have been. We produce what our parents produced. How we make it the way they did. Who gets what – this too is answered by tradition.

Command (Centralized) Economies

In a command economy, governmental planning groups make the basic economic decisions. They determine such things as which goods and services to produce, their prices, and the wage rates. Cuba and North Korea are examples of command economies. Notice this type is often referred to as Communism.

What to produce? The government or a body of people or maybe even just one person makes this decision for the whole society.

How to produce? Again – the government makes this decision for everybody. If the government says robots will be used – then robots will make it all.

Who gets what? You guessed it – the government decides. In Russia – it is 12 oligarchs. In North Korea – it is Kim Jong-un. The rest of society gets very little.

Market (Decentralized) Economies

In decentralized market economy, economic decisions are guided by the changes in prices that occur as individual buyers and sellers interact in the marketplace. This type of economy is often referred to as the price system, free market or capitalism. In the graphic above it is referred to as pure market or capitalism. The economies of the United States, Singapore, and Japan are identified as market economies since prices play a significant role in guiding economic activity.

- What – based on what consumers want

- How – based on the most efficient way the producers want to produce

- Who – whoever can pay for it

Mixed Economies

There are no pure command or pure market economies, to some degree, all modern economies have characteristics of both systems and are therefore referred to as mixed economies. For example, in the United States the government makes many important economic decisions, even though the price system is still predominant. Even in strict command economies, private individuals frequently engage in market activities, particularly in small towns and villages.

In the US mixed economy (Market and Command) for the most part consumers make the majority of the decisions. The government does make some rules to follow and they do tax us to provide services that we need (garbage disposal, military protection, etc.)

Key Point to Remember about Scarcity:

Every individual and every society must deal with the problem of scarcity. Every society, regardless of its political structure, must develop an economic system to determine how to use its limited resources to answer the three basic questions of what, how and for whom to produce.

Dealing with Scarcity – Opportunity Cost

Because of scarcity… there are no free lunches!

Because of scarcity, any time a choice is made, there are alternatives that are not chosen. More precisely, there is always one next best alternative that is not chosen. Remember, in economics, the value of the next best alternative is called opportunity cost. Both producers, (those who provide goods and services) and consumers (those who use goods and services) incur opportunity costs when making decisions. For example, the business person who uses a building to operate an insurance business cannot use the same building to produce pizzas. The consumer who uses scarce income to purchase new carpet will have to forgo saving the money or purchasing something else. Because there are always alternate uses for limited resources, every economic decision has an opportunity cost.

A major goal of economics is to recognize and evaluate opportunity cost when making a decision. This is one of the major distinctions between the study of business and the study of economics. As consumers, we should realize that the cost of buying an item is not really its price; rather, it is the most valued item that cannot be bought. For producers, the opportunity cost is the next most valuable good or service that is not produced as a result of the decision to produce something else.

The concept of opportunity cost also relates to the use of time. Since time is scarce, the time spent doing one activity and not spent doing another is a cost.

CLEAR IT UP

What is the opportunity cost associated with increased airport security measures?

After the terrorist plane hijackings on September 11, 2001, many steps were proposed to improve air travel safety. For example, the federal government could provide armed “sky marshals” who would travel inconspicuously with the rest of the passengers. The cost of having a sky marshal on every flight would be roughly $3 billion per year. Retrofitting all U.S. planes with reinforced cockpit doors to make it harder for terrorists to take over the plane would have a price tag of $450 million. Buying more sophisticated security equipment for airports, like three-dimensional baggage scanners and cameras linked to face recognition software, could cost another $2 billion.

However, the single biggest cost of greater airline security does not involve spending money. It is the opportunity cost of additional waiting time at the airport. According to the United States Department of Transportation (DOT), there were 895.5 million systemwide (domestic and international) scheduled service passengers in 2015. Since the 9/11 hijackings, security screening has become more intensive, and consequently, the procedure takes longer than in the past. Say that, on average, each air passenger spends an extra 30 minutes in the airport per trip. Economists commonly place a value on time to convert an opportunity cost in time into a monetary figure. Because many air travelers are relatively high-paid business people, conservative estimates set the average price of time for air travelers at $20 per hour. By these back-of-the-envelope calculations, the opportunity cost of delays in airports could be as much as 800 million × 0.5 hours × $20/hour, or $8 billion per year. Clearly, the opportunity costs of waiting time can be just as important as costs that involve direct spending.

In some cases, realizing the opportunity cost can alter behavior. Imagine, for example, that you spend $8 on lunch every day at work. You may know perfectly well that bringing a lunch from home would cost only $3 a day, so the opportunity cost of buying lunch at the restaurant is $5 each day (that is, the $8 buying lunch costs minus the $3 your lunch from home would cost). Five dollars each day does not seem to be that much. However, if you project what that adds up to in a year—250 days a year × $5 per day equals $1,250, the cost, perhaps, of a decent vacation. If you describe the opportunity cost as “a nice vacation” instead of “$5 a day,” you might make different choices.

Key Point to Remember about Opportunity Cost and Scarcity:

Resources are limited and have alternative uses. Every economic choice has an opportunity cost.

Real Life Examples

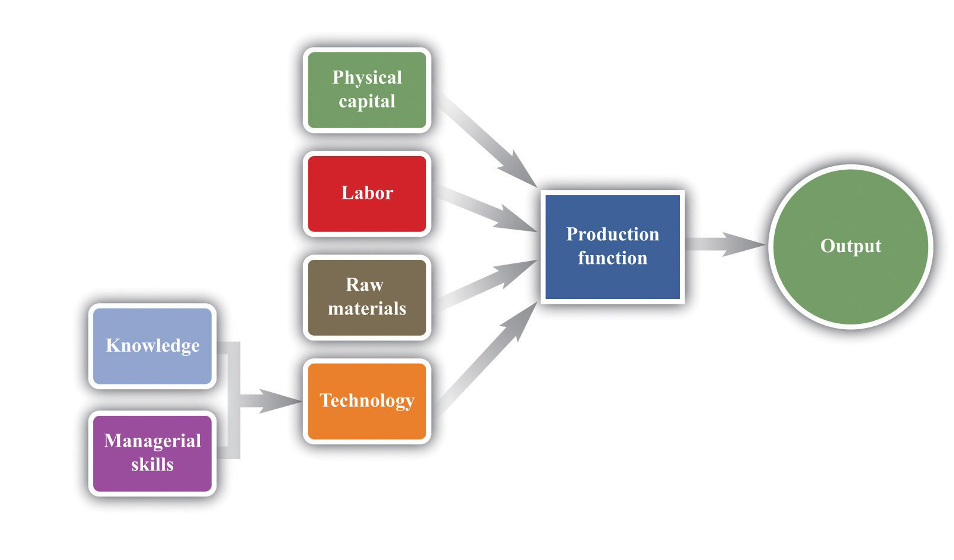

Productivity: Key to Minimize the Effects of Scarcity

Production and Productivity

Economic activity is directed toward a distinct goal: minimizing the effects of scarcity. In doing so, individuals and societies almost instinctively pursue economic activities which enable them to satisfy the most important of their wants using the fewest resources as possible. This has never been an easy task and has created much hardship. The progress that has been made and minimizing the effects of scarcity has been largely due to a more efficient use of the productive resources in the production process. Remember, the productive resources are land, labor, capital and entrepreneurial ability.

Economists refer to finish goods and services as output. Productive resources are the inputs. The important concept, productivity, measures the amount of output produced relative to the inputs used. Productivity = Output/Input

Since labor (human resources) is a relatively easy input to measure, and since it relates directly to wages and living standards, the term productivity usually refers to labor productivity and it is measured in terms of output per labor hour worked.

If workers produce 8 bookmarks in one hour, then 8/1, or 8 is the measure of their productivity. If they can produce 16 identical bookmarks and that same hour, this would be an increase in productivity.

In the long run, minimizing the effects of scarcity depends on increasing productivity. Societies that have a high level of productivity typically also have a high standard of living. Health standards improve and life expectancy also increases with increased productivity. The basic economic problem of scarcity cannot be eliminated but its effects can be reduced.

Three Ways to increase Productivity or Economic Growth

- Adequate Amounts of Capital: workers are more productive when they use tools, machines, and equipment. An adequate stock capital for workers is necessary for high levels of productivity

- Improvements in Technology: A framer using a tractor can produce more than a farmer using a hoe. Technology improves stock the capital has been the greatest factor in increasing productivity. For more on technology development, see the Industrial Revolution

- Improvements in the Quality of Labor: Labor that is better trained and educated is more productive than unskilled labor. Increase in skills resulting from education, experience, and training is referred to as human capital.

- Increases in Specialization and Exchange: Because individuals are endowed with different skills and interests and because the time and resources necessary to learn new skills are scare, there is a strong tendency towards specialization in production of goods and services. This leads invariably to an increase in productivity. Cobbler specializes in making shoes, while accountant specializes in processing taxes.

The Price System: How the Market Directs Economic Activity

Because of scarcity, all societies must determine how to use their limited productive resources to answer the basic economic questions of what, how, and for whom to produce. To one degree or another, societies rely on the price system to accomplish this task.

Societies which rely primarily on the prices are often called market economies or possibly capitalism.

Prices as Guide

In a market economy, changing prices in the marketplace guide economic activity, simultaneously coordinating the diverse interests of millions of individuals and their role as producers and consumers. For example, suppose that a new craze for tennis results in consumers purchasing more tennis rackets. If this is the only change in the market, the increase in demand for tennis rackets will cause their price to rise, resulting in more profits for producers of tennis rackets. The rise in profits will encourage existing producers to make and sell more rackets and it will also encourage new racket producers to enter the market. Eventually, the supply of tennis rackets will increase and the price will fall again.

The important point to notice in this example is how prices coordinated with independent desires of consumers and producers. The rise in tennis racket prices communicated to producers that consumers desired more tennis rackets, provided financial incentive to producers (in the form of increased profits) to meet the desire in the most efficient way possible, and determined who would get the rackets (those who were more willing and able to pay for them).

What is striking about the price system’s ability to answer these “what, how and for whom” questions, is the efficiency with which it is accomplished. This efficiency occurs because those who want to buy and sell products are free to do so and the way that benefits them the most, in competition with others. It is not necessary for the government to estimate a society’s future desire for particular goods and services and then organize their production and distribution. In the price system, this complicated task happens more or less automatically, without government involvement.

“Every individual endeavors to employ his capital so that its produce may be of greatest value. He generally neither intends to promote the public interest, nor knows how much he is promoting it. He intends only his own security, only his own gain. and he is in this led by an invisible hand to promote and in which was no part of his intention. By pursuing his own interest, he frequently promotes society more hen when he really intends to promote it.”

Government in Economics

Price Floors

When the government intervenes in a market economy to set or control prices, results are predictable. If the price of a good or service is set above the true market price determined by supply and demand, there will be a surplus. This is because at higher prices the quantity of a good supplied by the producers will increase, while the quantity of goods demanded by consumers will decrease. The surplus of agricultural products and some countries is a good example. For more, Price Controls

Price Ceilings

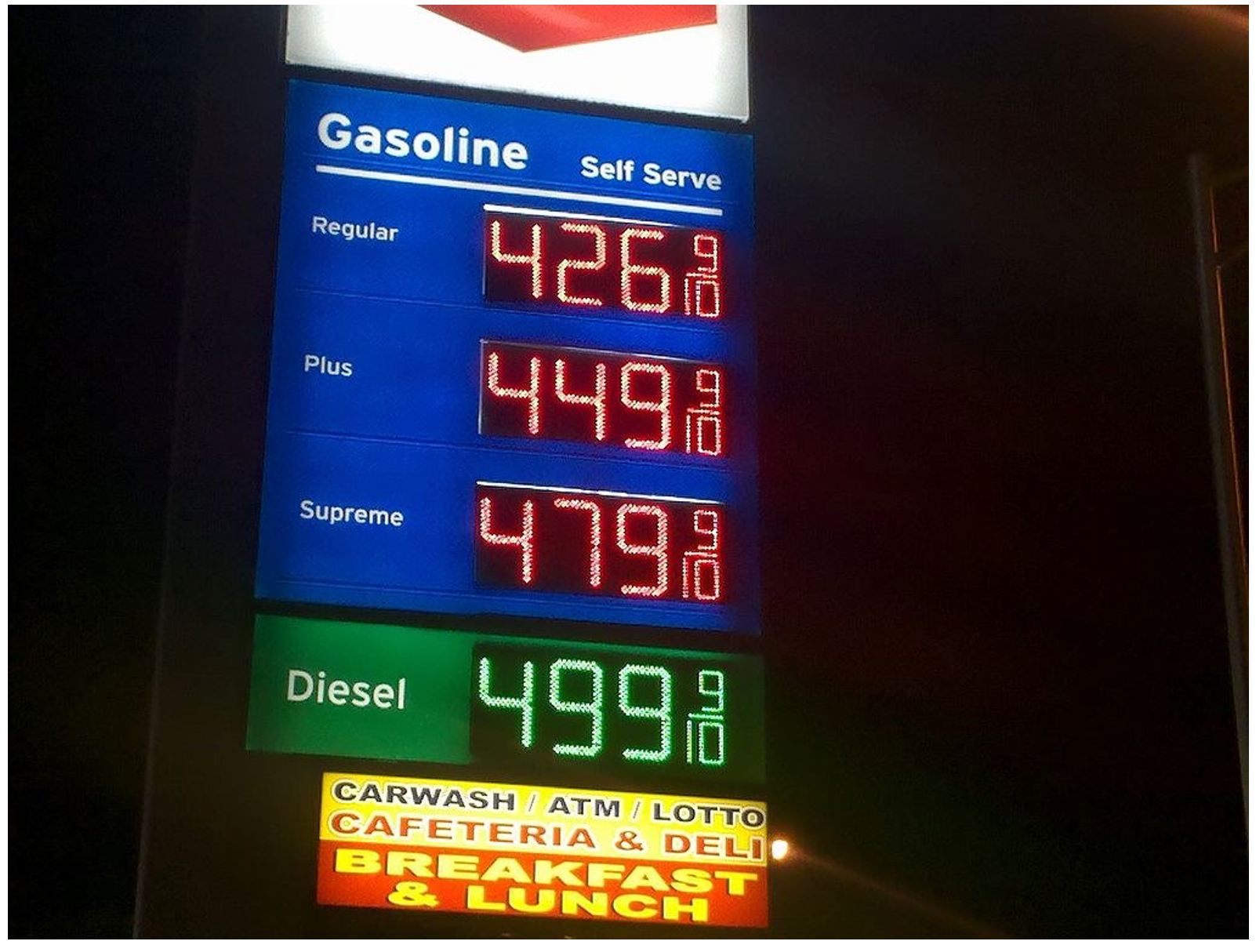

The opposite happens if the government sets the prices of goods or services below free market prices. In this case, the quantity of a good supplied by producers will decrease, while the quantity demanded by consumers will increase, resulting in a shortage characterized by long lines and shortages. Prices below market levels helped create the gasoline shortages of the 1970s in the United States. For more, Gas Prices 1970s

Market Equilibrium

Market price of a good or service is often referred to as the equilibrium price. This is a price that equalizes the amount producers want to sell and consumers want to buy. It is the price that clears the market for goods and services.

Different Roles of Government in Mixed Market Economy

Provide a legal framework. Without an effective legal framework, the prices system cannot operate effectively. Government provides a legal framework when it enforces private contracts, define private property rights, establishes uniform weights and measures and establishes and enforces laws and rules governing marketplace activity.

Ensures competition the price market system operates effectively when there are many buyers and many sellers competing in the marketplace the government uses its powers to ensure that one seller (Monopolies) or a few sellers(oligopoly) do not control specific area of the economy to the detriment of consumers. The government also establishes public service commission to regulate natural monopolies such as utility companies

Provides public goods and services Certain goods and services, known as public goods and services will be provided in less than the desired amount if production is left of the market system alone. The government, therefore, provides these goods and services. Examples include national defense, roads, flood control projects, and libraries, etc.

Controls externalities Certain market transactions result in externalities or spillovers, that cause good or bad effects on others who are not directly part of the transactions. Pollution is an example of a negative spillover since polluters can pass on the effects or cost of pollution to others, the government attempts to correct the situation by prohibiting or regulating certain production activities. Education is commonly cited as a positive spillover. Since the individuals and society other than the direct recipients and providers of the education also benefit, the government uses taxes to provide public education.

Redistributes income The government uses tax revenues to provide a social” safety net” for individuals with little to no income. Examples include Medicaid, SNAP food benefits, public housing, earned income tax credit and free and reduced lunches.

Stabilizes the economy The US economy is characterized by business cycles that create hardships for many people. In downturns (recessions) there is little or no economic growth, often resulting in significant unemployment. In upturns, there may be more inflation. The government uses fiscal policy (taxing and spending decisions), and the Federal Reserve Banking System uses monetary policy (money supply decisions) to help keep the economy as stable as possible.

NOTE: Not everyone agrees that government should assume all the roles above. Some believe that government may do more harm than good when it redistributes income and when it attempts to stabilize the economy. In general, they contend that the growth of the government results in a loss of individual liberty.

Access for free at https://openstax.org/books/principles-economics-3e