5 Achieving Macroeconomic Goals

Learning Objectives

- How does the government use monetary policy and fiscal policy to achieve its macroeconomic goals?

To reach macroeconomic goals, countries must often choose among conflicting alternatives. Sometimes political needs override economic needs. For example, bringing inflation under control may call for a politically difficult period of high unemployment and low growth. Or, in an election year, politicians may resist raising taxes to curb inflation. Still, the government must try to guide the economy to a sound balance of growth, employment, and price stability. The two main tools it uses are monetary policy and fiscal policy.

Monetary Policy

Monetary policy is exercised by the Federal Reserve System (“the Fed”), which is empowered to take various actions that decrease or increase the money supply and raise or lower short-term interest rates, making it harder or easier to borrow money. When the Fed believes that inflation is a problem, it will use contractionary policy to decrease the money supply and raise interest rates. When rates are higher, borrowers have to pay more for the money they borrow, and banks are more selective in making loans. Because money is “tighter”—more expensive to borrow—demand for goods and services will go down, and so will prices. In any case, that’s the theory.

The Fed will typically tighten or decrease the money supply during inflationary periods, making it harder to borrow money.

To counter a recession, the Fed uses expansionary policy to increase the money supply and reduce interest rates. With lower interest rates, it’s cheaper to borrow money, and banks are more willing to lend it. We then say that money is “easy.” Attractive interest rates encourage businesses to borrow money to expand production and encourage consumers to buy more goods and services. In theory, both sets of actions will help the economy escape or come out of a recession.

Fiscal Policy

The other economic tool used by the government is fiscal policy, its program of taxation and spending. By cutting taxes or by increasing spending, the government can stimulate the economy. Look again at Exhibit 1.6. The more government buys from businesses, the greater the business revenues and output. Likewise, if consumers or businesses have to pay less in taxes, they will have more income to spend for goods and services. Tax policies in the United States therefore affect business decisions. High corporate taxes can make it harder for U.S. firms to compete with companies in countries with lower taxes. As a result, companies may choose to locate facilities overseas to reduce their tax burden.

Nobody likes to pay taxes, although we grudgingly accept that we have to. Although most U.S. citizens complain that they are overtaxed, we pay lower taxes per capita (per person) than citizens in many countries similar to ours. In addition, our taxes represent a lower percentage of gross income and GDP compared to most countries.

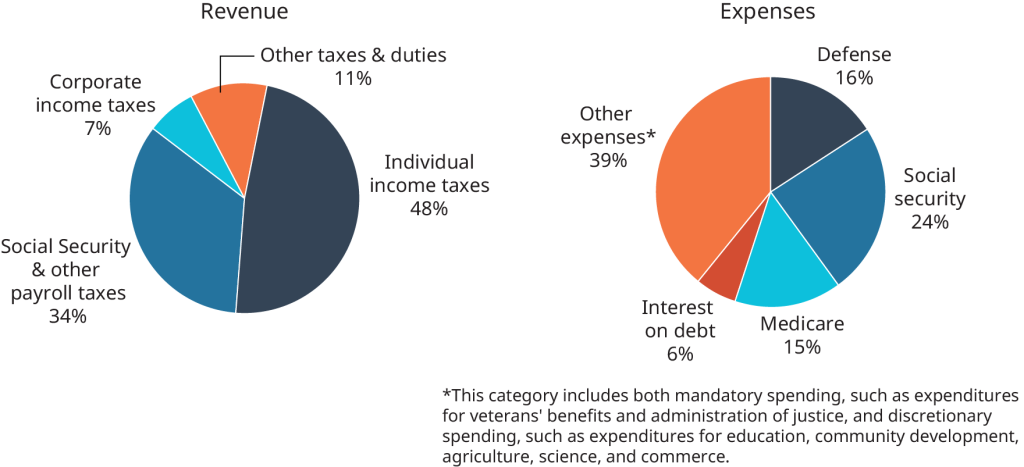

Taxes are, of course, the major source of revenue for our government. Every year, the president prepares a budget for the coming year based upon estimated revenues and expenditures. Congress receives the president’s report and recommendations and then, typically, debates and analyzes the proposed budget for several months. The president’s original proposal is always modified in numerous ways. Exhibit 1.9 shows the sources of revenue and expenses for the U.S. budget.

The National Debt

If, in any given year, the government takes in more money (through taxes) than it spends on goods and services (for things such as defense, transportation, and social services), the result is a budget surplus. If, on the other hand, the government spends more than it takes in, we have a budget deficit (which the government pays off by borrowing through the issuance of Treasury bonds). Historically, deficits have occurred much more often than surpluses; typically, the government spends more than it takes in. Consequently, the U.S. government now has a total national debt of more than $37 trillion (Note: This number is moving too quickly for the authors to keep the graph current—you can see the current debt at http://www.usdebtclock.org/).

Concept check

- What are the two kinds of monetary policy?

- What fiscal policy tools can the government use to achieve its macroeconomic goals?

- What problems can a large national debt present?

Media Attributions

- 1.8

- 1.9