Thought Provokers

Thought Provokers

TP 1. Choose three stakeholders (or stakeholder groups) for Walmart and prepare a written response for each stakeholder. In your written response, consider the factors about the business the particular stakeholder would be interested in. Consider the financial and any nonfinancial factors that would be relevant to the stakeholder (or stakeholder group). Explain why these factors are important. Do some research and see if you can find support for your points.

TP 2. Assume you purchased ten shares of Roku during the company’s IPO. Comment on why this might be a good investment. Consider factors such as what you expect to get from your investment, why you think Roku would become a publicly traded company, and what you think is the landscape of the industry Roku is in. What other factors might be relevant to your decision to invest in Roku?

TP 3. A trademark is an intangible asset that has value to a business. Assume that you are an accountant with the responsibility of valuing the trademark of a well-known company such as Nike or McDonald’s. What makes each of these companies unique and adds value? While the value of a trademark may not necessarily be recorded on the company’s balance sheet, discuss what factors you think would affect (increase or decrease) the value of the company’s trademark? Consider your answer through the perspective of various stakeholders.

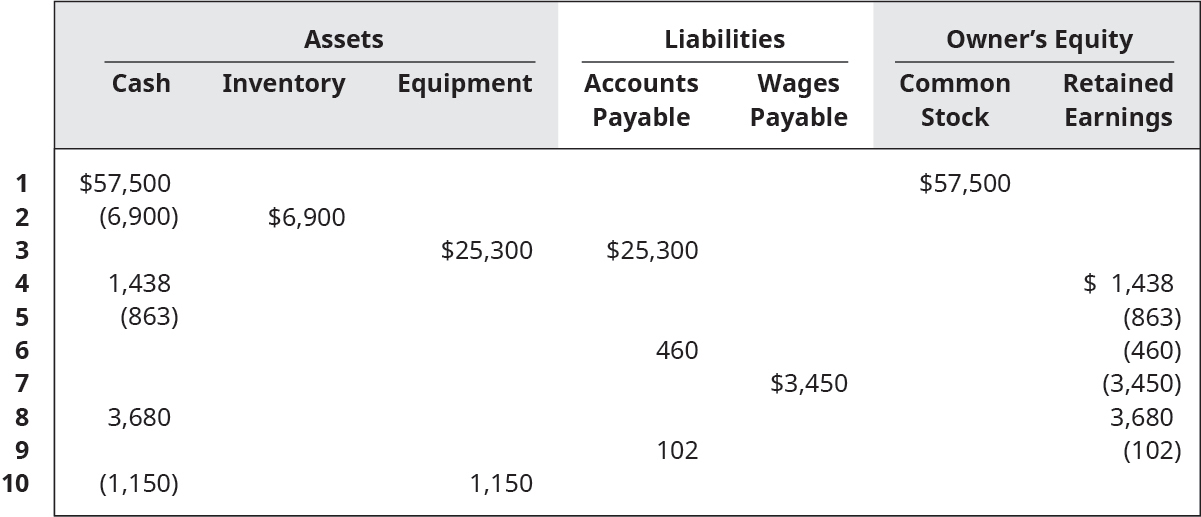

TP 4. For each of the following ten independent transactions, provide a written description of what occurred in each transaction. Figure 2.4 might help you.

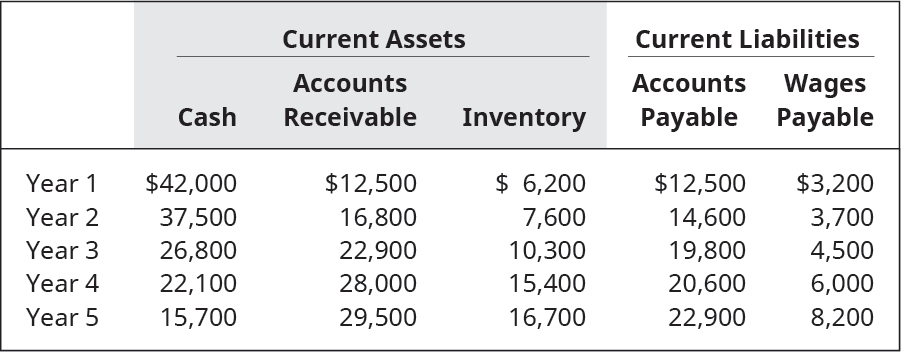

TP 5. The following historical information is from Assisi Community Markets.

Calculate the working capital and current ratio for each year. What observations do you make, and what actions might the owner consider taking?

A free copy of this content can be found at: https://openstax.org/books/principles-financial-accounting