Problem Set B

Problem Set B

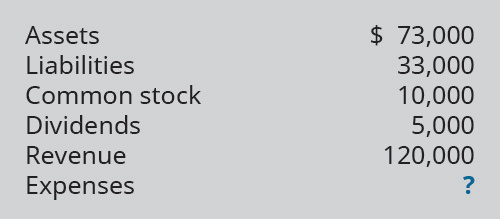

PB 1. Assuming the following account balances, what is the missing value?

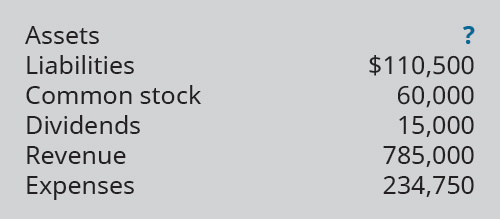

PB 2. Assuming the following account balance changes for the period, what is the missing value?

PB 3. Assuming the following account balance changes for the period, what is the missing value?

PB 4. Identify the financial statement on which each of the following account categories would appear: the balance sheet (BS), the income statement (IS), or the retained earnings statement (RE).

|

|

Financial statement |

Normal balance |

|

Accounts Receivable |

|

|

|

Automobile Expense |

|

|

|

Cash |

|

|

|

Equipment |

|

|

|

Notes Payable |

|

|

|

Service Revenue |

|

|

Table 3.20

PB 5. Indicate what impact (+ for increase; – for decrease) the following transactions would have on the accounting equation, Assets = Liabilities + Equity.

|

Transaction |

Impact 1 |

Impact 2 |

|

Paid balance due for accounts payable |

|

|

|

Charged clients for legal services provided |

|

|

|

Purchased supplies on account |

|

|

|

Collected legal service fees from clients for current month |

|

|

|

Issued stock in exchange for a note receivable |

|

|

Table 3.21

PB 6. Indicate how changes in these types of accounts would be recorded (Dr for debit; Cr for credit).

|

|

Debit or credit? |

|

Asset accounts |

|

|

Liability accounts |

|

|

Common Stock |

|

|

Revenue |

|

|

Expense |

|

Table 3.22

PB 7. Identify the normal balance (Dr for Debit; Cr for Credit) and type of account (A for asset, L for liability, E for equity, E-rev for revenue, E-exp for expense, and E-eq for equity) for each of the following accounts.

|

|

Normal balance |

Account type |

|

Utility Expense |

|

|

|

Accounts Receivable |

|

|

|

Interest Revenue |

|

|

|

Retained Earnings |

|

|

|

Land |

|

|

|

Sales Revenue |

|

|

Table 3.23

PB 8. Indicate the net effect (+ for increase; – for decrease; 0 for no effect) of each of the following transactions on each part of the accounting equation, Assets = Liabilities + Equity. For example, for payment of an accounts payable balance, A (–) = L (–) + E (0).

- Payment of principal balance of note payable

- Purchase of supplies for cash

- Payment of dividends to stockholders

- Issuance of stock for cash

- Billing customer for physician services provided

PB 9. Prepare journal entries to record the following transactions. Create a T-account for Cash, post any entries that affect the account, and calculate the ending balance for the account. Assume a Cash beginning balance of $37,400.

- May 12, collected balance due from customers on account, $16,000

- June 10, purchased supplies for cash, $4,444

PB 10. Prepare journal entries to record the following transactions. Create a T-account for Accounts Payable, post any entries that affect the account, and calculate the ending balance for the account. Assume an Accounts Payable beginning balance of $7,500.

- May 12, purchased merchandise inventory on account. $9,200

- June 10, paid creditor for part of previous month’s purchase, $11,350

PB 11. Prepare journal entries to record the following transactions that occurred in April:

- on first day of the month, issued common stock for cash, $15,000

- on eighth day of month, purchased supplies, on account, $1,800

- on twentieth day of month, billed customer for services provided, $950

- on twenty-fifth day of month, paid salaries to employees, $2,000

- on thirtieth day of month, paid for dividends to shareholders, $500

PB 12. Prepare journal entries to record the following transactions that occurred in March:

- on first day of the month, purchased building for cash, $75,000

- on fourth day of month, purchased inventory, on account, $6,875

- on eleventh day of month, billed customer for services provided, $8,390

- on nineteenth day of month, paid current month utility bill, $2,000

- on last day of month, paid suppliers for previous purchases, $2,850

PB 13. Post the following November transactions to T-accounts for Accounts Payable, Inventory, and Cash, indicating the ending balance. Assume no beginning balances in Accounts Payable and Inventory, and a beginning Cash balance of $21,220.

- purchased merchandise inventory on account, $9,900

- paid vendors for part of inventory purchased earlier in month, $6,500

- purchased merchandise inventory for cash, $4,750

PB 14. Post the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts.

- sold products to customers for cash, $7,500

- sold products to customers on account, $12,650

- collected cash from customer accounts, $9,500

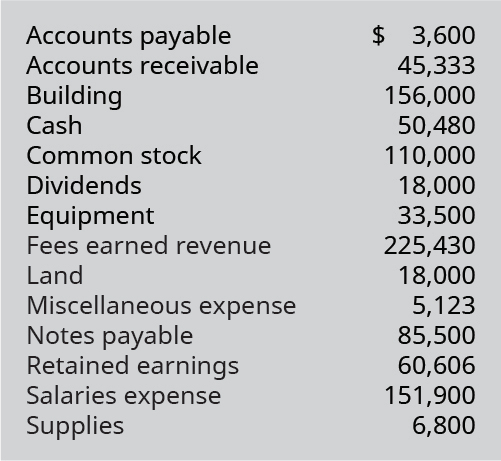

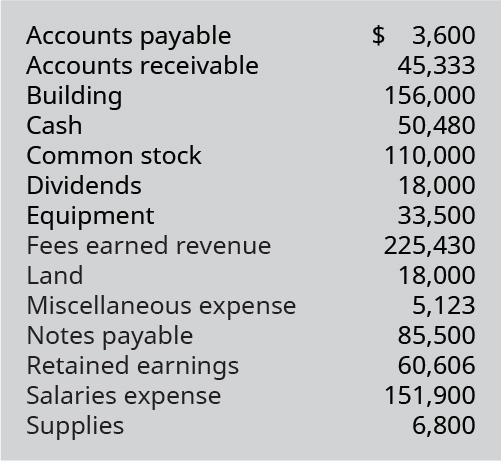

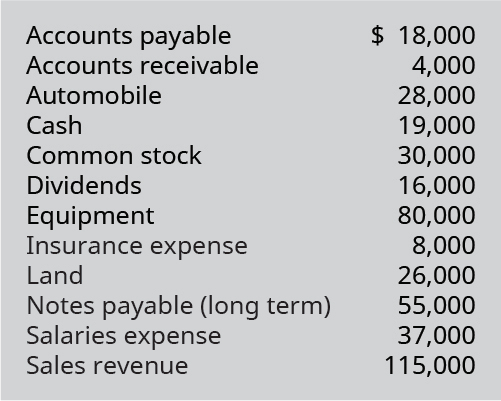

PB 15. LO 3.6Prepare an unadjusted trial balance, in correct format, from the following alphabetized account information. Assume all accounts have normal balances.

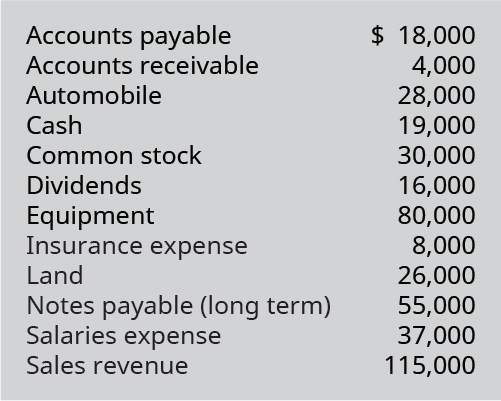

PB 16. Prepare an unadjusted trial balance, in correct format, from the following alphabetized account information. Assume all accounts have normal balances.

PB 17. Prepare an unadjusted trial balance, in correct format, from the following alphabetized account information. Assume all accounts have normal balances.

PB 18. Prepare an unadjusted trial balance, in correct format, from the following alphabetized account information. Assume all accounts have normal balances.

A free copy of this content can be found at: https://openstax.org/books/principles-financial-accounting