Problem Set A

Problem Set A

PA 1. For each of the following situations write the principle, assumption, or concept that justifies or explains what occurred.

- A landscaper received a customer’s order and cash prepayment to install sod at a house that would not be ready for installation until March of next year. The owner should record the revenue from the customer order in March of next year, not in December of this year.

- A company divides its income statements into four quarters for the year.

- Land is purchased for $205,000 cash; the land is reported on the balance sheet of the purchaser at $205,000.

- Brandy’s Flower Shop is forecasting its balance sheet for the next five years.

- When preparing financials for a company, the owner makes sure that the expense transactions are kept separate from expenses of the other company that he owns.

- A company records the expenses incurred to generate the revenues reported.

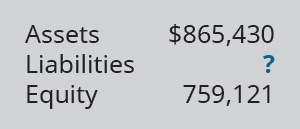

PA 2. Assuming the following account balances, what is the missing value?

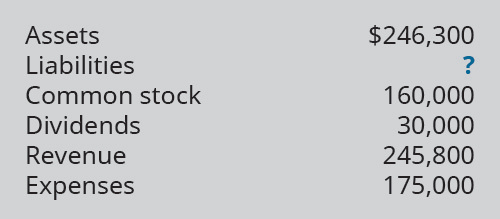

PA 3. Assuming the following account balance changes for the period, what is the missing value?

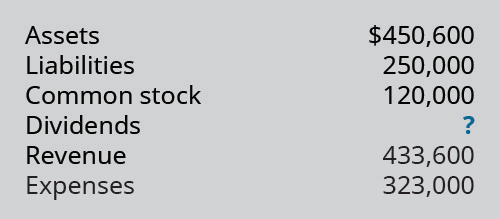

PA 4. Assuming the following account balance changes for the period, what is the missing value?

PA 5. Identify the financial statement on which each of the following account categories would appear: the balance sheet (BS), the income statement (IS), or the retained earnings statement (RE). Indicate the normal balance (Dr for debit; Cr for credit) for each account category.

|

|

Financial statement |

Normal balance |

|---|---|---|

|

Assets |

|

|

|

Common stock |

|

|

|

Dividends |

|

|

|

Expenses |

|

|

|

Liabilities |

|

|

|

Revenue |

|

|

Table 3.15

PA 6. Indicate what impact (+ for increase; – for decrease) the following transactions would have on the accounting equation, Assets = Liabilities + Equity.

|

|

Impact 1 |

Impact 2 |

|---|---|---|

|

Issued stock for cash |

|

|

|

Purchased supplies on account |

|

|

|

Paid employee salaries |

|

|

|

Paid note payment to bank |

|

|

|

Collected balance on accounts receivable |

|

|

Table 3.16

PA 7. Indicate how changes in the following types of accounts would be recorded (Dr for debit; Cr for credit).

|

|

Increase |

Decrease |

|---|---|---|

|

Asset accounts |

|

|

|

Liability accounts |

|

|

|

Common stock |

|

|

|

Revenue |

|

|

|

Expense |

|

|

Table 3.17

PA 8. Identify the normal balance (Dr for Debit; Cr for Credit) and type of account (A for asset, L for liability, E for equity, E-rev for revenue, E-exp for expense, and E-c for contra) for each of the following items.

|

|

Normal balance |

Account type |

|---|---|---|

|

Accounts Payable |

|

|

|

Supplies |

|

|

|

Inventory |

|

|

|

Common Stock |

|

|

|

Dividends |

|

|

|

Salaries Expense |

|

|

Table 3.18

PA 9. Indicate the net effect (+ for increase; – for decrease; 0 for no effect) of each of the following transactions on each part of the accounting equation, Assets = Liabilities + Equity. For example, for payment of an accounts payable balance, A (–) = L (–) + E (0).

- sale of merchandise to customer on account

- payment on note payable

- purchase of equipment for cash

- collection of accounts receivable

- purchase of supplies on account

PA 10. Identify whether the following transactions would be recorded with a debit (Dr) or credit (Cr) entry. Indicate the normal balance of the account.

|

Transaction |

Debit or credit? |

Normal balance |

|---|---|---|

|

Equipment increase |

|

|

|

Dividends Paid increase |

|

|

|

Repairs Expense increase |

|

|

|

Service revenue decrease |

|

|

|

Miscellaneous Expense increase |

|

|

|

Bonds Payable decrease |

|

|

Table 3.19

PA 11. The following information is provided for the first month of operations for Legal Services Inc.:

- The business was started by selling $100,000 worth of common stock.

- Six months’ rent was paid in advance, $4,500.

- Provided services in the amount of $1,000. The customer will pay at a later date.

- An office worker was hired. The worker will be paid $275 per week.

- Received $500 in payment from the customer in “C”.

- Purchased $250 worth of supplies on credit.

- Received the electricity bill. We will pay the $110 in thirty days.

- Paid the worker hired in “D” for one week’s work.

- Received $100 from a customer for services we will provide next week.

- Dividends in the amount of $1,500 were distributed.

Prepare the necessary journal entries to record these transactions. If an entry is not required for any of these transactions, state this and explain why.

PA 12. Sewn for You had the following transactions in its first week of business.

- Jessica Johansen started Sewn for You, a seamstress business, by contributing $20,000 and receiving stock in exchange.

- Paid $2,250 to cover the first three months’ rent.

- Purchased $500 of sewing supplies. She paid cash for the purchase.

- Purchased a sewing machine for $1,500 paying $200 cash and signing a note for the balance.

- Finished a job for a customer earning $180. The customer paid cash.

- Received a $500 down payment to make a wedding dress.

- Received an electric bill for $125 which is due to be paid in three weeks.

- Completed an altering job for $45. The customer asked to be billed.

Prepare the necessary journal entries to record these transactions. If an entry is not required for any of these transactions, state this and explain why.

PA 13. George Hoskin started his own business, Hoskin Hauling. The following transactions occurred in the first two weeks:

- George Hoskin contributed cash of $12,000 and a truck worth $10,000 to start the business. He received Common Stock in return.

- Paid two months’ rent in advance, $800.

- Agreed to do a hauling job for a price of $1,200.

- Performed the hauling job discussed in “C.” We will get paid later.

- Received payment of $600 on the hauling job done in “D.”

- Purchased gasoline on credit, $50.

- Performed another hauling job. Earned $750, was paid cash.

Record the following transactions in T-accounts. Label each entry with the appropriate letter. Total the T-accounts when you are done.

PA 14. Prepare journal entries to record the following transactions. Create a T-account for Cash, post any entries that affect the account, and calculate the ending balance for the account. Assume a Cash beginning balance of $16,333.

- February 2, issued stock to shareholders, for cash, $25,000

- March 10, paid cash to purchase equipment, $16,000

PA 15. Prepare journal entries to record the following transactions. Create a T-account for Accounts Payable, post any entries that affect the account, and tally ending balance for the account. Assume an Accounts Payable beginning balance of $5,000.

- February 2, purchased an asset, merchandise inventory, on account, $30,000

- March 10, paid creditor for part of February purchase, $12,000

PA 16. Prepare journal entries to record the following transactions for the month of July:

- on first day of the month, paid rent for current month, $2,000

- on tenth day of month, paid prior month balance due on accounts, $3,100

- on twelfth day of month, collected cash for services provided, $5,500

- on twenty-first day of month, paid salaries to employees, $3,600

- on thirty-first day of month, paid for dividends to shareholders, $800

PA 17. Prepare journal entries to record the following transactions for the month of November:

- on first day of the month, issued common stock for cash, $20,000

- on third day of month, purchased equipment for cash, $10,500

- on tenth day of month, received cash for accounting services, $14,250

- on fifteenth day of month, paid miscellaneous expenses, $3,200

- on last day of month, paid employee salaries, $8,600

PA 18. Post the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts.

- on first day of the month, sold products to customers for cash, $13,660

- on fifth day of month, sold products to customers on account, $22,100

- on tenth day of month, collected cash from customer accounts, $18,500

PA 19. Post the following November transactions to T-accounts for Accounts Payable, Inventory, and Cash, indicating the ending balance. Assume no beginning balances in Accounts Payable and Inventory, and a beginning Cash balance of $36,500.

- purchased merchandise inventory on account, $16,000

- paid vendors for part of inventory purchased earlier in month, $12,000

- purchased merchandise inventory for cash, $10,500

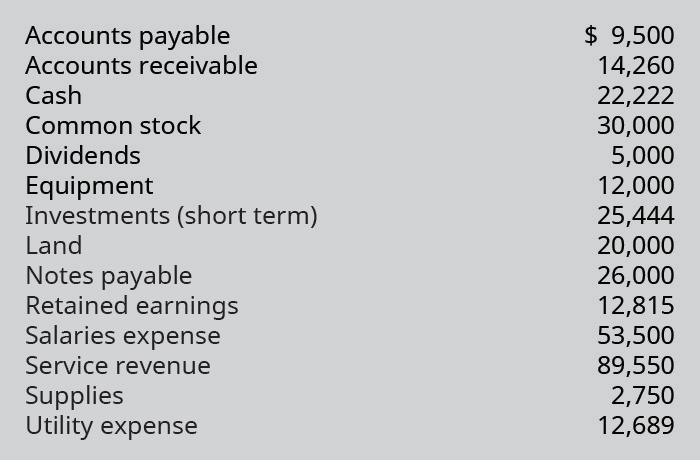

PA 20. Prepare an unadjusted trial balance, in correct format, from the following alphabetized account information. Assume accounts have normal balances.

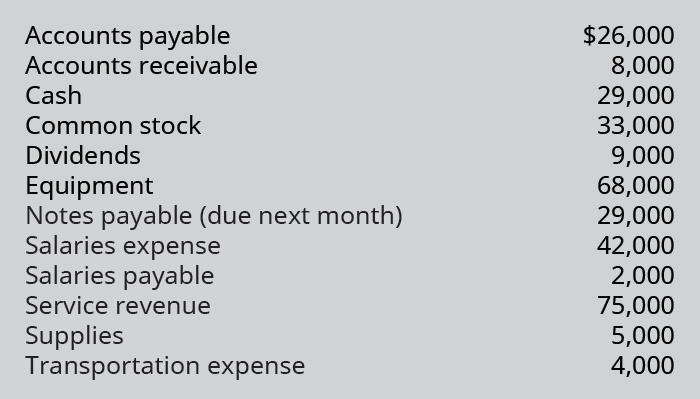

PA 21. Prepare an unadjusted trial balance, in correct format, from the following alphabetized account information. Assume all the accounts have normal balances.

A free copy of this content can be found at: https://openstax.org/books/principles-financial-accounting