Problem Set A

Problem Set A

PA 1. The following information is taken from the records of Baklava Bakery for the year 2019.

| Revenues: Jan. | $22,500 |

| Gains: Feb. | $1,200 |

| Losses: Mar. | $3,700 |

| Expenses: Feb. | $21,620 |

| Gains: Jan. | $0 |

| Revenues: Mar. | $42,800 |

| Losses: Feb. | $1,600 |

| Expenses: Mar. | $45,100 |

| Losses: Jan. | $0 |

| Revenues: Feb. | $37,550 |

| Expenses: Jan. | $20,760 |

| Gains: Mar. | $5,600 |

- Calculate net income or net loss for January.

- Calculate net income or net loss for February.

- Calculate net income or net loss for March.

- For each situation, comment on how a stakeholder might view the firm’s performance. (Hint: Think about the source of the income or loss.)

PA 2. Each situation below relates to an independent company’s owners’ equity.

| Beginning Balance + | Net Income – | Net Loss + | Investments – | Distributions = | Ending Balance | |

| Co. 1 | ? | $16,500 | $0 | $22,300 | $1,750 | $37,050 |

| Co. 2 | $63,180 | $0 | $12,000 | $0 | ? | $44,880 |

| Co. 3 | $275,300 | ? | $0 | $0 | $24,100 | $299,400 |

- Calculate the missing values.

- Based on your calculations, make observations about each company.

PA 3. The following information is from a new business. Comment on the year-to-year changes in the accounts and possible sources and uses of funds (how were the funds obtained and used).

| Assets – | Liabilities = | Owner’s Equity | |

| End of year 1 | $245,000 | $120,000 | $125,000 |

| End of year 2 | $286,000 | $150,000 | $136,000 |

| End of year 3 | $212,000 | $80,000 | $132,000 |

PA 4. Each of the following situations relates to a different company.

| Company A | Company B | Company C | Company D | |

| Revenues | $16,500 | $167,320 | ? | $235,000 |

| Expenses | $12,400 | ? | $72,300 | $241,000 |

| Gains | $750 | $1,350 | $0 | ? |

| Losses | $900 | $6,240 | $5,200 | $0 |

| Net Income or (Loss) | ? | ($9,250) | $5,100 | $6,300 |

- For each of these independent situations, find the missing amounts.

- How would stakeholders view the financial performance of each company? Explain.

PA 5. For each of the following independent transactions, indicate whether there was an increase, a decrease, or no impact for each financial statement element.

|

Transaction |

Assets |

Liabilities |

Owners’ Equity |

|

Paid cash for expenses |

|

|

|

|

Sold common stock for cash |

|

|

|

|

Owe vendor for purchase of asset |

|

|

|

|

Paid owners for dividends |

|

|

|

|

Paid vendor for amount previously owed |

|

|

|

Table 2.9

PA 6. Olivia’s Apple Orchard had the following transactions during the month of September, the first month in business.

| Transaction | Amount | Asset – | Liability = | Owner’s Equity |

| Amount owed for land purchase | $50,000 | $50,000 | $50,000 | $0 |

| Apple sales: cash | $3,000 | ? | ? | ? |

| Apple sales: credit | $6,000 | ? | ? | ? |

| Collections of credit sales | $4,000 | ? | ? | ? |

| Cash purchase of equipment | $10,000 | ? | ? | ? |

| Owner investments | $25,000 | ? | ? | ? |

| Wages expenses paid | $6,000 | ? | ? | ? |

| Fuel expenses paid | $400 | ? | ? | ? |

| Amount owed for utility expense | $1,000 | ? | ? | ? |

| Current totals | $50,000 | $50,000 | $0 |

Complete the chart to determine the ending balances. As an example, the first transaction has been completed. Note: Negative amounts should be indicated with minus signs (–) and unaffected should be noted as $0.

(Hints: 1. each transaction will involve two financial statement elements; 2. the net impact of the transaction may be $0.)

PA 7. Using the information in Exercise 2.6, determine the amount of revenue and expenses for Olivia’s Apple Orchard for the month of September.

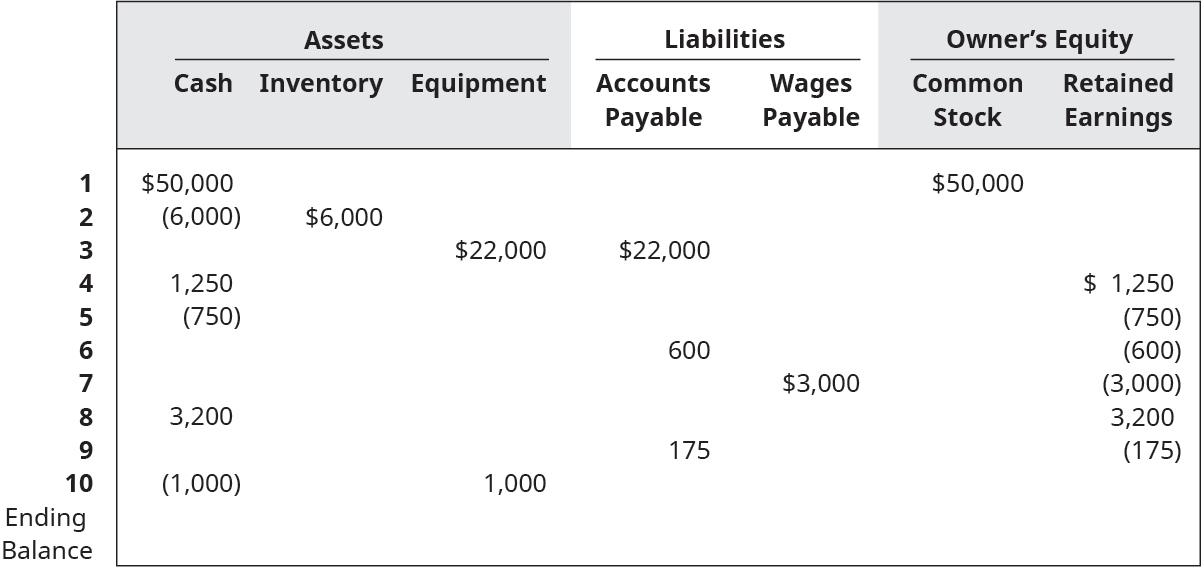

PA 8. The following ten transactions occurred during the July grand opening of the Pancake Palace. Assume all Retained Earnings transactions relate to the primary purpose of the business.

- Calculate the ending balance for each account.

- Create the income statement.

- Create the statement of owner’s equity.

- Create the balance sheet.

A free copy of this content can be found at: https://openstax.org/books/principles-financial-accounting