14 Introduction

Figure 19.1 The Great Depression At times, such as when many people having trouble making ends meet, it is easy to tell how the economy is doing. This photograph shows people lined up during the Great Depression, waiting for relief checks. At other times, when some are doing well and others are not, it is more difficult to ascertain how the economy of a country is doing. (Credit: modification of “Waiting for relief checks. Calipatria, California” by Dorothea Lange/Library of Congress Prints and Photographs Division Washington, D.C. 20540 USA, Public Domain)

Learning Objectives

In this chapter, you will learn about:

- Measuring the Size of the Economy: Gross Domestic Product

- Adjusting Nominal Values to Real Values

- Tracking Read GDP over Time

- Comparing GDP among Countries

- How Well GDP Measures the Well-Being of Society

Introduction to the Macroeconomic Perspective

Bring It Home

How is the Economy Doing? How Does One Tell?

The 1990s were boom years for the U.S. economy. Beginning in the late 2000s, from 2007 to 2014, economic performance in the U.S. was poor. The economy experienced another period of strong growth between 2014 and 2019, before COVID-19 rocked the world economy in March and April of 2020. What causes the economy to expand or contract? Why do businesses fail when they are making all the right decisions? Why do workers lose their jobs when they are hardworking and productive? Are bad economic times a failure of the market system? Are they a failure of the government? These are all questions of macroeconomics, which we will begin to address in this chapter. We will not be able to answer all of these questions here, but we will start with the basics: How is the economy doing? How can we tell?

The macro economy includes all buying and selling, all production and consumption; everything that goes on in every market in the economy. How can we get a handle on that? The answer begins more than 80 years ago, during the Great Depression. President Franklin D. Roosevelt and his economic advisers knew things were bad—but how could they express and measure just how bad it was? An economist named Simon Kuznets, who later won the Nobel Prize for his work, came up with a way to track what the entire economy is producing. In this chapter, you will learn how the government constructs GDP, how we use it, and why it is so important.

Goals and Major Questions:

Macroeconomics focuses on the economy as a whole (or on whole economies as they interact). What causes recessions? What makes unemployment stay high when recessions are supposed to be over? Why do some countries grow faster than others? Why do some countries have higher standards of living than others? These are all questions that macroeconomics addresses. Macroeconomics involves adding up the economic activity of all households and all businesses in all markets to obtain the overall demand and supply in the economy.

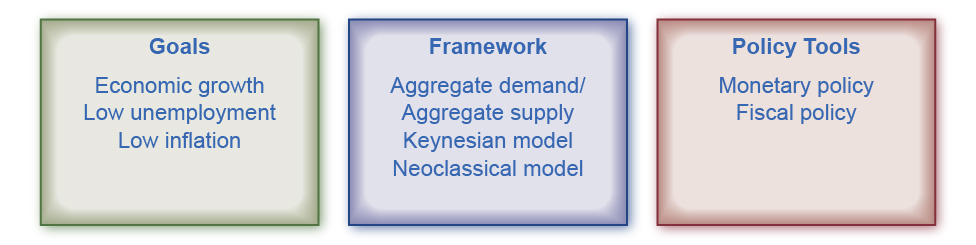

Macroeconomics is a rather massive subject. How are we going to tackle it? Figure 19.2 illustrates the structure we will use. We will study macroeconomics from three different perspectives:

- What are the macroeconomic goals?

- What are the frameworks economists can use to analyze the macroeconomy?

- Finally, what are the policy tools governments can use to manage the macroeconomy?

Macroeconomic Goals

In thinking about the macroeconomy’s overall health, it is useful to consider three primary goals:

- economic growth

- low unemployment

- low inflation ( price stability)

Economic growth ultimately determines the prevailing standard of living in a country. Economists measure growth by the percentage change in real (inflation-adjusted) gross domestic product. A growth rate of more than 3% is considered stable.

Unemployment, as measured by the unemployment rate, is the percentage of people in the labor force who do not have a job. When people lack jobs, the economy is wasting a precious resource-labor, and the result is lower goods and services produced. Unemployment, however, is more than a statistic—it represents people’s livelihoods. While measured unemployment is unlikely to ever be zero, economists consider a measured unemployment rate of 5% or less low (stable).

Inflation(or price stability) is a sustained increase in the overall level of prices, and is measured by the consumer price index. If many people face a situation where the prices that they pay for food, shelter, and healthcare are rising much faster than the wages they receive for their labor, there will be widespread unhappiness as their standard of living declines. For that reason, low inflation—an inflation rate of 1–2%—is a major goal and is considered stable.

Frameworks

The Keynesian perspective will be briefly discussed, each of which has its own version of Aggregate Demand and Aggregate Supply. For the macroeconomic student, please see the related chapters in your book. For the economic survey student, this is not in your required content.

Policy Tools – Fiscal and Monetary

National governments have two tools for influencing the larger economy. The first is monetary policy, which involves managing the money supply and interest rates and is led by the Federal Reserve. The second is fiscal policy, which is led by the government and involves changes in government spending/purchases and taxes.

As you learn these things, you will discover that the goals and the policy tools are in the news almost every day.

Access for free at https://openstax.org/books/principles-economics-3e