43 Tracking Inflation

Tracking Inflation

Learning Objectives

By the end of this section, you will be able to:

- Calculate the annual rate of inflation

- Explain and use index numbers and base years when simplifying the total quantity spent over a year for products

- Calculate inflation rates using index numbers

Dinner table conversations where you might have heard about inflation usually entail reminiscing about when “everything seemed to cost so much less. You used to be able to buy three gallons of gasoline for a dollar and then go see an afternoon movie for another dollar.” Table 22.1 compares some prices of common goods in 1970 and 201. At the beginning of 2021, $1 had about the same purchasing power in overall terms of goods and services as 15 cents did in 1972, because of the amount of inflation that has occurred over that time period.

| Items | 1970 | 2021 |

| Pound of ground beef | $0.66 | $5.96 |

| Pound of butter | $0.87 | $3.50 |

| Movie ticket | $1.55 | $13.70 |

| Sales price of a new home (median) | $22,000 | $408,800 |

| New car | $3,000 | $42,000 |

| Gallon of gasoline | $0.36 | $3.32 |

| Average hourly wage for a manufacturing worker | $3.23 | $30.11 |

| Per capita GDP | $5,069 | $63,543 |

Table 22.1 Price Comparisons, 1970 and 2021 (Sources: See chapter References at end of book.)

Moreover, the power of inflation does not affect just goods and services, but wages and income levels, too. The second-to-last row of Table 22.1 shows that the average hourly wage for a manufacturing worker increased nearly ten-fold from 1970 to 2021. The average worker in 2021 is better educated and more productive than the average worker in 1970—but not six times more productive.

A modern economy has millions of goods and services whose prices are continually quivering in the breezes of supply and demand. How can all of these shifts in price attribute to a single inflation rate? Economists combine prices of a variety of goods and services into a single price level. The inflation rate is simply the percentage change in the price level.

The Price of a Basket of Goods

To calculate the price level, economists begin with the concept of a basket of goods and services, consisting of the different items individuals, businesses, or organizations typically buy.

The next step is to look how the prices of those items change over time. In thinking about how to combine individual prices into an overall price level, many people find that their first impulse is to calculate the average of the prices. Such a calculation, however, could easily be misleading because some products matter more than others.

Changes in the prices of goods for which people spend a larger share of their incomes will matter more than changes in the prices of goods for which people spend a smaller share of their incomes. For example, an increase of 10% in the rental rate on housing matters more to most people than whether the price of carrots rises by 10%. To construct an overall measure of the price level, economists compute a weighted average of the prices of the items in the basket, where the weights are based on the actual quantities of goods and services people buy.

The following Work It Out feature walks you through the steps of calculating the annual rate of inflation based on a few products.

Work It Out

Calculating an Annual Rate of Inflation

Consider the simple basket of goods with only three items, represented in Table 22.2. Say that in any given month, a college student spends money on 20 hamburgers, one bottle of aspirin, and five movies. The table provides prices for these items over four years through each time period (Pd). Prices of some goods in the basket may rise while others fall. In this example, the price of aspirin does not change over the four years, while movies increase in price and hamburgers bounce up and down. The table shows the cost of buying the given basket of goods at the prices prevailing at that time.

| Items | Hamburger | Aspirin | Movies | Total | Inflation Rate |

| Qty | 20 | 1 bottle | 5 | – | – |

| (Pd 1) Price | $3.00 | $10.00 | $6.00 | – | – |

| (Pd 1) Amount Spent | $60.00 | $10.00 | $30.00 | $100.00 | – |

| (Pd 2) Price | $3.20 | $10.00 | $6.50 | – | – |

| (Pd 2) Amount Spent | $64.00 | $10.00 | $32.50 | $106.50 | 6.5% |

| (Pd 3) Price | $3.10 | $10.00 | $7.00 | – | – |

| (Pd 3) Amount Spent | $62.00 | $10.00 | $35.00 | $107.00 | 0.5% |

| (Pd 4) Price | $3.50 | $10.00 | $7.50 | – | – |

| (Pd 4) Amount Spent | $70.00 | $10.00 | $37.50 | $117.50 | 9.85 |

Table 22.2 A College Student’s Basket of Goods

To calculate the annual rate of inflation in this example:

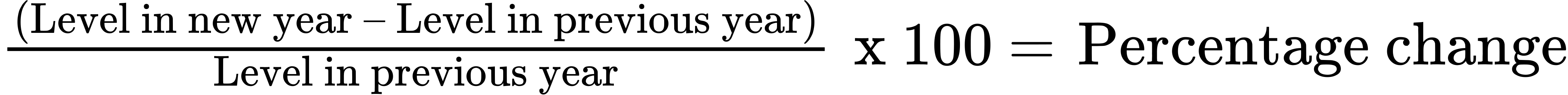

Step 1. Find the percentage change in the cost of purchasing the overall basket of goods between the time periods. The general equation for percentage changes between two years, whether in the context of inflation or in any other calculation, is:

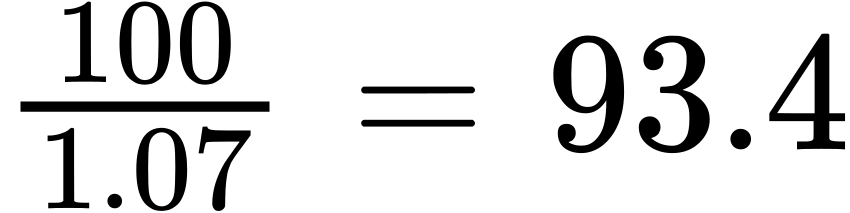

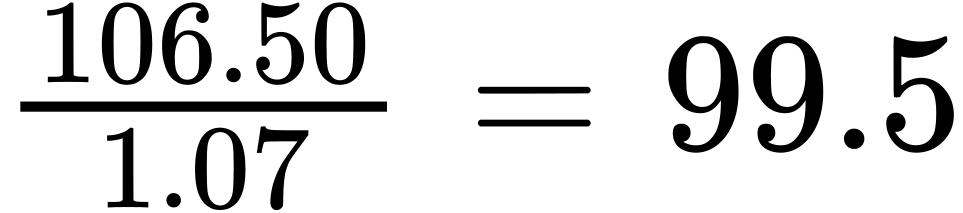

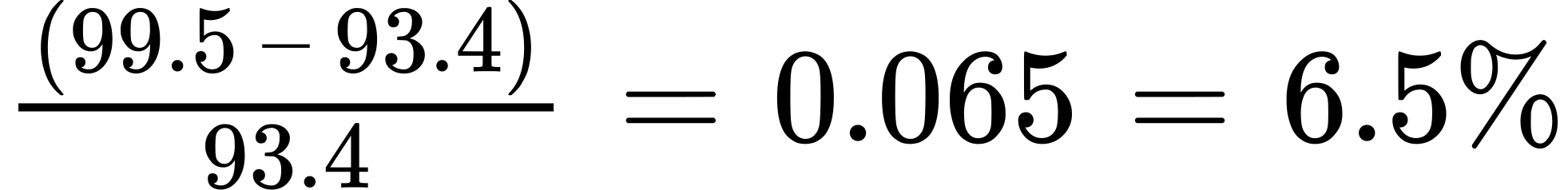

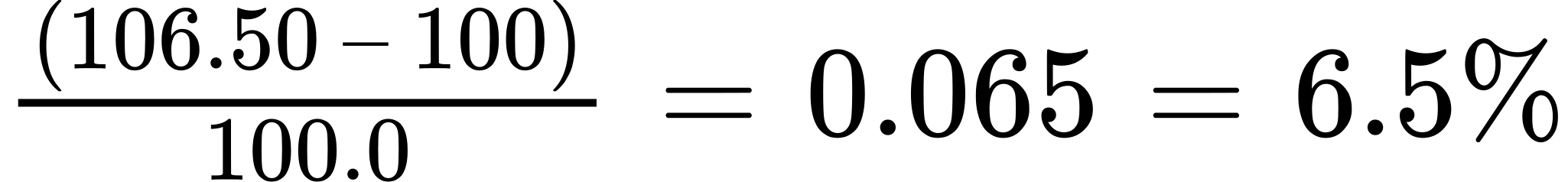

Step 2. From period 1 to period 2, the total cost of purchasing the basket of goods in Table 22.2 rises from $100 to $106.50. Therefore, the percentage change over this time—the inflation rate—is:

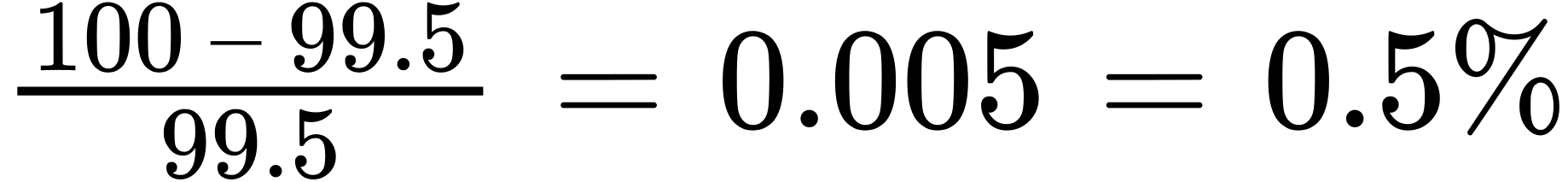

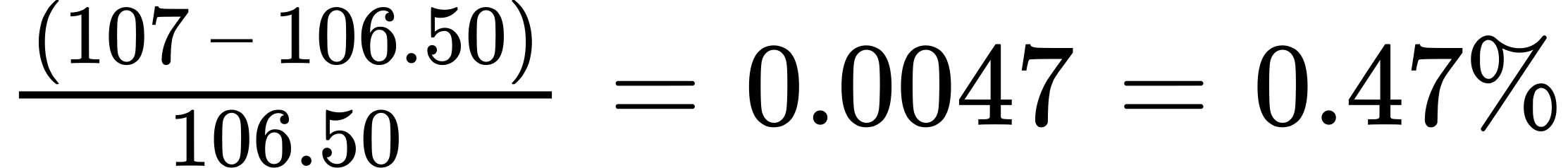

Step 3. From period 2 to period 3, the overall change in the cost of purchasing the basket rises from $106.50 to $107. Thus, the inflation rate over this time, again calculated by the percentage change, is approximately:

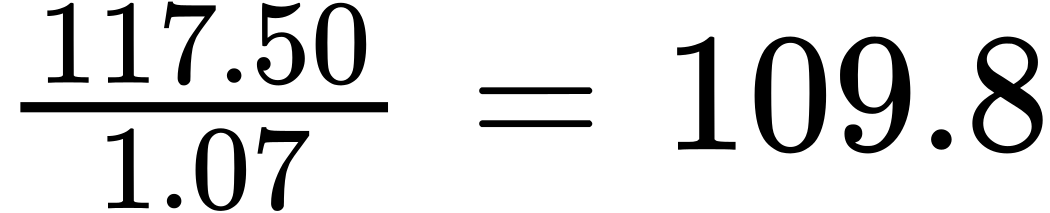

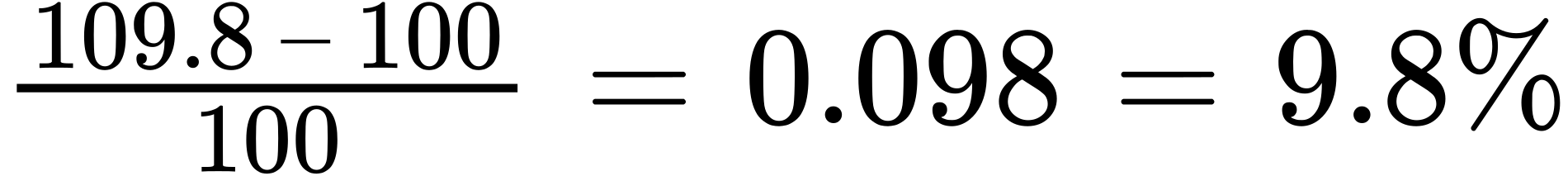

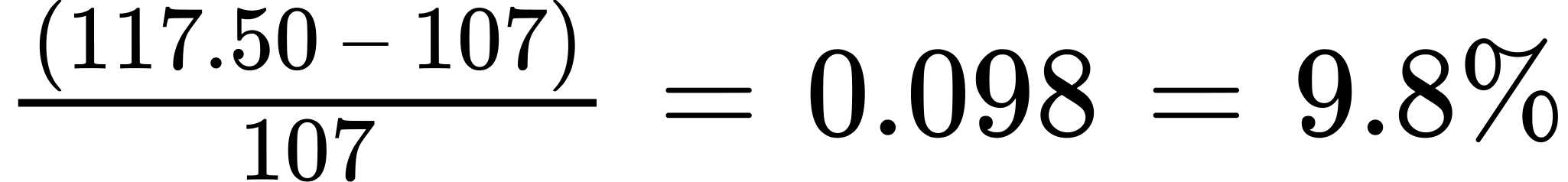

Step 4. From period 3 to period 4, the overall cost rises from $107 to $117.50. The inflation rate is thus:

This calculation of the change in the total cost of purchasing a basket of goods accounts for how much a student spends on each good. Hamburgers are the lowest-priced good in this example, and aspirin is the highest-priced. If an individual buys a greater quantity of a low-price good, then it makes sense that changes in the price of that good should have a larger impact on the buying power of that person’s money. The larger impact of hamburgers shows up in the “amount spent” row, where, in all time periods, hamburgers are the largest item within the amount spent row.

Index Numbers

The numerical results of a calculation based on a basket of goods can get a little messy. The simplified example in Table 22.2 has only three goods and the prices are in even dollars, not numbers like 79 cents or $124.99. If the list of products were much longer, and we used more realistic prices, the total quantity spent over a year might be some messy-looking number like $17,147.51 or $27,654.92.

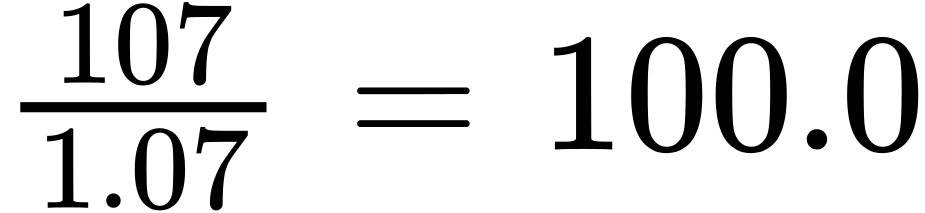

To simplify the task of interpreting the price levels for more realistic and complex baskets of goods, economists typically report the price level in each period as an index number, rather than as the dollar amount for buying the basket of goods. Economists create price indices to calculate an overall average change in relative prices over time. To convert the money spent on the basket to an index number, economists arbitrarily choose one year to be the base year, or starting point from which we measure changes in prices. The base year, by definition, has an index number equal to 100. This sounds complicated, but it is really a simple math trick. In the example above, say that we choose time period 3 as the base year. Since the total amount of spending in that year is $107, we divide that amount by itself ($107) and multiply by 100. Again, this is because the index number in the base year always has to have a value of 100. Then, to figure out the values of the index number for the other years, we divide the dollar amounts for the other years by 1.07 as well. Note also that the dollar signs cancel out so that index numbers have no units.

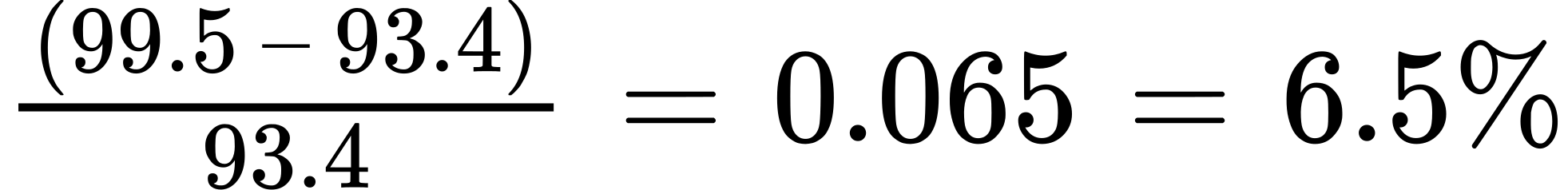

Table 22.3 shows calculations for the other values of the index number, based on the example in Table 22.2. Because we calculate the index numbers so that they are in exactly the same proportion as the total dollar cost of purchasing the basket of goods, we can calculate the inflation rate based on the index numbers, using the percentage change formula. Thus, the inflation rate from period 1 to period 2 would be

This is the same answer that we derived when measuring inflation based on the dollar cost of the basket of goods for the same time period.

| Total Spending | Index Number | Inflation Rate Since Previous Period | |

| Period 1 | $100 |

|

|

| Period 2 | $106.50 |

|

|

| Period 3 | $107 |

|

|

| Period 4 | $117.50 |

|

|

Table 22.3 Calculating Index Numbers When Period 3 is the Base Year

If the inflation rate is the same whether it is based on dollar values or index numbers, then why bother with the index numbers? The advantage is that indexing allows easier eyeballing of the inflation numbers. If you glance at two index numbers like 107 and 110, you know automatically that the rate of inflation between the two years is about, but not quite exactly equal to, 3%. By contrast, imagine that we express the price levels in absolute dollars of a large basket of goods, so that when you looked at the data, the numbers were $19,493.62 and $20,040.17. Most people find it difficult to eyeball those kinds of numbers and say that it is a change of about 3%. However, the two numbers expressed in absolute dollars are exactly in the same proportion of 107 to 110 as the previous example.

Two final points about index numbers are worth remembering. First, index numbers have no dollar signs or other units attached to them. Although we can use index numbers to calculate a percentage inflation rate, the index numbers themselves do not have percentage signs. Index numbers just mirror the proportions that we find in other data. They transform the other data so that it is easier to work with the data.

Second, the choice of a base year for the index number—that is, the year that is automatically set equal to 100—is arbitrary. We choose it as a starting point from which we can track changes in prices. In the official inflation statistics, it is common to use one base year for a few years, and then to update it, so that the base year of 100 is relatively close to the present. However, any base year that we choose for the index numbers will result in exactly the same inflation rate. To see this in the previous example, imagine that period 1 is the base year when total spending was $100, and we assign it an index number of 100. At a glance, you can see that the index numbers would now exactly match the dollar figures, and the inflation rate in the first period would be 6.5%.

Link It Up

Watch this video from the cartoon Duck Tales to view a mini-lesson on inflation.

Access for free at https://openstax.org/books/principles-economics-3e